Thoughts on Jerome Powell's Housing Comments

At the recent Fed press conference, Jerome Powell said:

Coming out of the pandemic, rates were very low, people wanted to buy houses, they wanted to get out of the cities and buy houses in the suburbs because of COVID. So you really had a housing bubble, you had housing prices going up very unsustainable levels and overheating and that kind of thing. So, now the housing market will go through the other side of that and hopefully come out in a better place between supply and demand.

He also mentioned that CPI rent inflation tends to lag the change in new leases, which have already flattened out. This has led to some hindsight about Fed policy decisions in 2021, such as:

These discussions tend to hang on the common presumptions, such as that Fed policy has a direct and predictable effect on mortgage rates and that mortgage rates, in turn, have a direct and predictable effect on housing consumption and wealth.

While I wouldn’t argue that there is nothing to those presumptions, I would argue that they are commonly overstated enough to create a distorted view of the market.

Here are several posts about how rent rather than interest rates, could be the primary factor driving home values (1, 1a, 2, 3, 4, 5, 6).

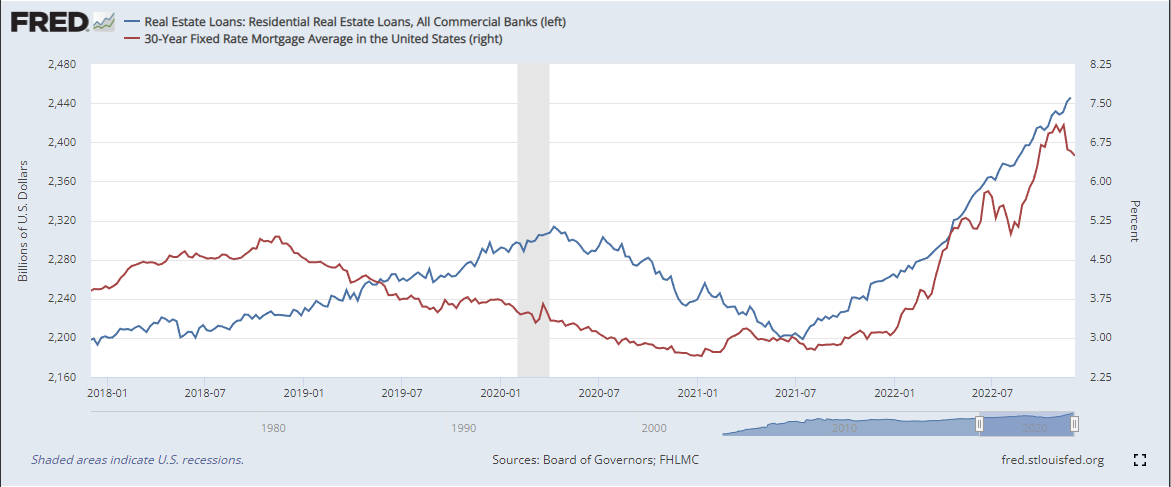

As the graph in Furman’s tweet shows, market rents have clearly risen at a faster pace than incomes have. Standard monetary or fiscal stimulus would operated through increased spending or incomes in general, but rents have been rising more than incomes. One explanation is that lower mortgage rates lead to higher housing consumption because home buyers can consume more for the same amount of debt service. (One problem with that theory is that mortgage outstanding don’t correlate very well with interest rates. Figure 1 shows the 30 year mortgage rate and mortgages outstanding at commercial banks. For a full year now, rising mortgage rates have been associated with the fastest growth in mortgages outstanding at commercial banks since the Great Recession.)

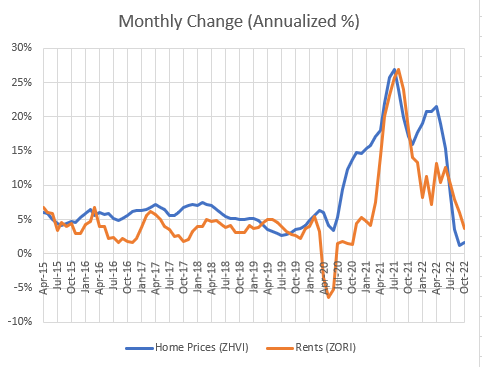

Figure 2 compares US median prices and rents, from Zillow since 2015. Generally, prices and rents have risen together, but there do appear to be 3 distinct periods. From June 2020 to about February 2021, prices increased by more than rents. Then, from about February 2021 to November 2021, rents and price appreciation both peaked at similar rates. Then, from November 2021 to about May 2022, there was a second period where prices outpaced rents. Since then, both have moderated.

This seems to fit well with a monetary stimulus story. During the first period, home sales jumped up significantly. Clearly homebuyer demand was driving the market. Unfortunately, at the same time, supply chain issues prevented those high sales from translating into more production. Eventually, when backlogs became extended, builders started to meter sales by raising prices and limiting availability. The spike in rents occurred after sales were slowed. Then, briefly prices spiked again until rising interest rates slowed down activity. That seems like a story defined by low interest rates and inelastic supply. And, there is certainly something to it. But…. (You knew there would be a “but”.)

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.