American Economic Devolution & Land Rents

In previous posts, I have disaggregated American residential real estate value into various components. My basic method here is to use a stable price/rent ratio for both structures and land. The excess value that has accumulated in American real estate is all due to land rents that are associated with urban land use regulations that obstruct city-building.

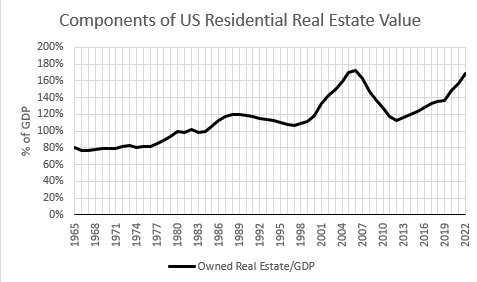

Figure 1 shows the value of owner-occupied real estate over time, as a percentage of GDP. It has grown from 80% to nearly 180% of GDP over the past 60 years.

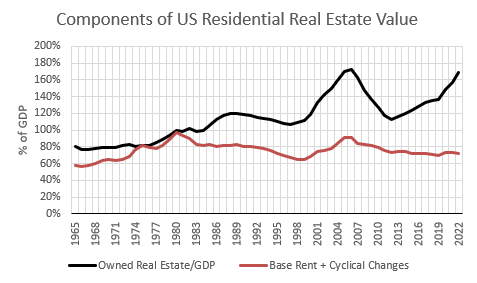

Figure 2 compares that total value to the value of real estate that I attribute to the rent of structures. Over time, the quantity and quality of homes per capita has increased, but it has not increased as fast as real incomes have. Since the 2008 mortgage crackdown, the value of structures has declined sharply as a percentage of GDP.

The non-inflated value of structures had been about 80% of GDP, but since 2008, it has declined to about 60% of GDP.

There are cyclical changes in home prices. (Cyclical changes to home prices don’t correlate well with interest rates, but there are cyclical changes.) In Figure 3, I have added cyclical changes to the base rental value. This is basically the value of residential real estate if the price/rent ratio changes over time, cyclically, proportionately for both the land and the structures.

This is what trips a lot of folks up, and makes housing analysts with a demand-side focus intransigent. There are cyclical changes in home values. And, from the late 1990s to the mid-2000s, there was a significant cyclical upturn from a cyclical bottom to a cyclical top. The portion of home values related to non-inflated structures increased from about 65% of GDP to 90% of GDP. That’s a lot!

What gets demand-side analysts stuck is that they misinterpret “a lot” to mean “the most important” or “the only” or “the factor that interacts with supply conditions, and cyclical components are the independent variable while supply conditions are a control variable”. Naturally, a nearly 50% increase in values that is unrelated to changes in the structures that should be the fundamental source of those values seems like a big deal. It is!

But the reason that home values topped out at 170% of GDP instead of 90% of GDP is almost entirely a supply-side story. It is almost entirely due to the high price/rent ratio on inflated land value. All the cyclical countermeasures in the world aren’t going to fix it, and all the demand-side anti-cycle policy choices have done is make us poorer.

Looking back at Figure 2, the demand-side anti-housing policy choices have reduced the base rental value of owner-occupied residential real estate down to 60% of GDP and inflated the value of land rents to more than 100% of GDP.

It’s a shame because there should be a pluralistic agreement that land rents are bad. But, conservative and libertarian political groups and economists who are tempted into those demand-side explanations (low interest rates, federal subsidies, generous underwriting, etc.) end up pissing in their own well water. Their policy choices have caused land rents to skyrocket and I think they just generally aren’t going to be able to get themselves straightened out. It’s practically impossible to extract yourself from a decades-old Greek chorus.

So, the professional and political motivation to reduce excess land rents will have to come from the basic experiential frustrations of young adults who simply can’t afford housing and are desperate to do something about it.

Finally, in Figure 4, I have added in the effect of tight lending standards since 2008. That has knocked home values down by an amount equal to about 25% of GDP. Attributing that proportionately to structure values and land rents, that has knocked the residential value of structures down by about 10% of GDP.

So, owner-occupied homes are worth just over 160% of GDP, but the actual structures are worth about 60% of GDP and the value of the land rents that come from urban housing obstructions are worth about 100% of GDP.

Keep in mind, this is mostly about the existing stock of homes. Land has become a larger portion of new home costs, so this does affect new home values somewhat, but new homes are mostly constructed where it is legal to construct them, and, thus, land values aren’t excessive. So, each new home that is constructed raises the red line a bit and lowers the black line by a bit more by lowering the land rents on other, existing homes.

New homes raise the aggregate value of structures but lower the land rents on other homes.

Another irony here is that tight lending standards are even worse than they seem. As I discuss with the Erdmann Housing Tracker data, these factors do not affect home values uniformly. Excess land rents that come from supply constraints mostly accumulate on homes with the lowest values. And tight lending standards mostly lower the values of homes with the lowest values.

So, the combination of supply constraints and mortgage constraints especially make the value of land rents higher and the price of the structures lower on the cheapest homes with the poorest tenants. The homes have inflated value because of land rents but they are especially cheap for those who can manage to buy them.

Under current lending regulations, those who can manage to buy them are Wall Street corporations who have come in to fill the gap where families with mortgages used to be the buyers. Investors are getting a discount on the structures so they can charge our poorest families more for land rents.

This is entirely due to urban land restrictions and federal mortgage restrictions. That outcome and the financial and organizational infrastructure that has arisen around it would mostly disappear if either of those restrictions were removed. As far as I can tell, it would be very easy to remove the federal mortgage restrictions. The White House could probably direct enough changes in GSE and FHA underwriting that would mostly reverse the outcome. Though, it would probably be a bit more difficult to reduce the restrictions on private lenders. My lone howl from out here in the wilderness won’t reach anyone’s ears who could do those things.

The political left isn’t going to lead a charge to reduce lender regulations and the political right is trapped in their Greek chorus.

So, we are probably going to legislatively limit Wall Street activity in new housing. That will lower the value of structures and increase the value of land rents even more. I don’t know how much farther the American housing market can bend before it breaks us, but I don’t see how the end game is anything but broken. I don’t think it is an overstatement to use the term human suffering to describe what is coming if the next move is to block Wall Street housing activity. I feel hopeless to stop it.

I suppose the historical analog of a country with little structural value but massive land rents is 19th century Ireland. (Well, 21st century Ireland, too.)

Think of it. We just might manage to end up in a situation where housing amounts to 200% of GDP while a million families are living in tents in our urban parks. It seems ironic. But, in fact, the two things are deeply related.

BTW, housing rents in Australia in May rose 7.5% on year.

In the span of a generation, Canada and Australia became places where ordinary middle-class people used to thrive...but became expensive and social fractious nations.

Erdmann gets it.

IMHO very solid commentary.

Longshot solution: The federal government bribes cities into de-zoning.

That is, the federal government provides payments, based on zip-code density, for un-zoning property. Maybe some sort of bonus for actual units constructed in dense areas, or formerly single-family detached zoned areas.

I can't imagine residents of single-family detached areas ever agreeing to high-rise condos with ground floor retail in "their" neighborhood. Or, supporting policies that will, through greater supply, lower the value of their homes, their largest investment.

But local governments are in need of money. Pension systems will bankrupt many cities and counties. So maybe officials can be "bribed."

I have more cheery thoughts, but that is enough for one day.