Today, yet another positive monthly labor report came out. JPow continues the winning. Wage growth is sustainable. Inflation is well past. The Atlanta Fed is projecting 5% real growth this quarter.

Everything seems to be lining up for some positive homebuilder earnings reports later this month, “in spite of” high interest rates.

Here are some scattered observations you may not see elsewhere.

Residential Construction and Employment

First, construction employment continues to grow. Residential construction employment had flattened out, but has started rising again in the last 2 months. And construction wages continue to rise at a reasonable clip.

Just for kicks, I revisited my recent posts on new home size, and compared that data to construction employment data.

In Figure 1, I compare my quarterly estimate of the quantity of new square footage completed with the number of residential construction employees. Generally, construction employment and production are rising together. Total new square footage per worker is a lot lower than it was before 2008, however. This makes it look like there is a major productivity issue.

But, I have written about this before. When we build enough new homes, old homes tend to depreciate until they are affordable for families with incomes that are lower over time. This is the fundamentally important process of filtering. (“Trickle down” as the mentally impaired refer to it.) When there aren’t enough new homes, residents with higher incomes claim the older homes, and they tend to improve and update them to maintain them at the higher standards they prefer. So, one sign of a dysfunctional housing market is that more residential investment goes into improvements. That is what happened after 2008.

In Figure 2, I compare the quantity of new square footage produced each year to the residential construction employment that is engaged in new construction rather than renovating older homes. (Employees x Non-improvement investment / total residential investment in structures).

As you can see, those measures line up quite well, going all the way back to 1987. So, instead of adding roughly a billion square feet of new housing annually, we are spending resources renovating existing units. Housing production is at capacity, but if we were building new units at the same proportion that we did before 2008, we would be building nearly a half million additional units annually with the same amount of resources.

Employment Flows

One part of the employment report I like to take a look at every now and then are employment flows. There are 3 main categories:

Employed

Unemployed

Not in Labor Force

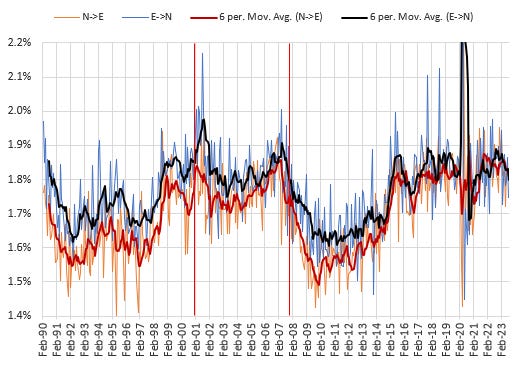

The BLS tracks workers switching from one category to another. Trends here might be able to add some color to broader economic trends. In the Figures E is “Employed”, U is “Unemployed”, and N is “Not in Labor Force”. In each case, the measure is the percentage of all workers in the 2 categories involved in the flow.

In Figure 3, the six different flows are shown. The flows into and out of unemployment basically rise along with measured unemployment, so they don’t appear to give any leading indication of a coming economic slowdown.

Figure 4 looks at the net flows. Basically, the difference between each of the three sets of flows. Flows into and out of the labor force, either with Employment or Unemployment don’t seem to provide much useful information. Net flows are pretty noisy, even using 6 month moving averages. But, flows from Employment to Unemployment do seem to demonstrate cyclical trends. And, the trend shift toward more flows to Unemployment appears to begin before unemployment rates start to rise sharply and before the official start of a recession. Also, it is hard to distinguish an upturn that predates a recession from an upturn that is about to shift back down.

Currently, it is hard to tell where this is going (the blue line). It is rising. There are increasing flows from Employment to Unemployment, but that could be a continuation of the recovery from the Covid recession. The flows might settle in here.

In Figure 5, I did a little deeper, and look just at the flows from Figure 3 between Employed and Not in the Labor Force. The net flows don’t convey a lot of information. But, looking at the trends in both directions, there was a shift in flows in both directions nearly a year before the start of the recession at the end of 2007. Flows in both directions between Employment and Not in Labor Force started to decline sharply in early 2007.

They are both headed down now, but still within normal noise levels. If these flows break down below the recent range, it might be an early sign of a break down in labor markets.

https://www.greenstreet.com/insights/CPPI

Someday you might want to ponder commercial real estate prices. They fell ~40% back in 2008-10.

Obviously, that is not related to easy money for homebuyers.

Stray thought: How does the US money supply actually expand (except possibly for QE)?

Through commercial bank loans...which are usually backed by collateral, meaning property.

So, a commercial bank "prints" up money, and gives it to a buyer, who buys property with it.

The buyer really doesn't keep the money. It goes to the seller.

So, when the Fed "expands the money supply" it essentially directs a lot of new printed (digitized) money to property sellers.

Less, when tightening up.

This is because central banks followed the private-sector creation of fractional reserve banks. They piggy-based on commercial banks.

From scratch, would anyone design the expansion or contraction of an economic system's money supply this way? That is, to expand the money supply you print up money and give it to property sellers?

Then to "tighten up" you put a noose around the property sector.

Would not money-financed fiscal programs make more sense?