Lance Lambert shared a new report from the Dallas Federal Reserve Bank, “Evidence suggests U.S. house price/rent ratio, real home prices to decline”.

I have a Mercatus paper coming out soon, which I took far too long to finish up, about the implications of inflated real estate valuations. The presumption of this paper is among the points that I will touch on in my paper.

Economists seem to universally treat price/rent ratios as if they have a stable mean - as if every change in price/rent ratios is caused by something other than rents, and that price/rent ratios should naturally revert back to some neutral value.

Almost all of the change in price/rent ratios is caused by changing rents. That means that the standard analysis is almost entirely wrongheaded. If you simply didn’t pay attention to price/rent ratios, you could reliably out-trade the average economist - even above average economists. They would systematically hand you trading gains simply for being willing to be ignorant or indifferent.

This is one of the key issues that has rendered the economics profession practically useless on the housing crisis.

I hate to say that. Most harsh critics of the Fed or of economics are crackpots, and so I would rather say that economists are getting it right, or maybe nitpick details. I hate that I have to make such a broad criticism.

I am not the most well-read researcher in the world. There hypothetically could be a paper out there that makes this point. How many real estate economics programs are there? Surely somebody thought to question this assumption, somewhere. But, if that paper is out there, nobody else has read it either, because paper after paper gets published where nobody asks the author to question the stable mean in price/rent ratios.

There is a similar problem with mortgage access. A multi-sigma change in mortgage access happened in 2008, and nobody controls for it. You would think that a generation-defining policy change might have gotten somebody’s attention somewhere. It would have been discussed at a panel at some economics conference. The data isn’t a secret. The New York Fed tracks it. Several institutions publish indexes. Fannie and Freddie report the credit scores of their book of mortgages.

Again, maybe there are papers that I haven’t read that give that fact its due, but paper after paper gets published that fails to control for it.

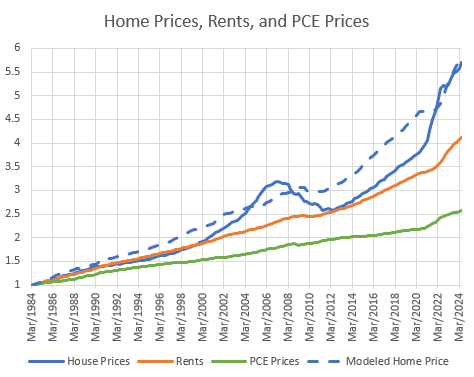

Anyway, on this Dallas Fed paper, it starts with this figure:

Then it follows up with this figure:

And, then all the remaining analysis focuses on single cycles. So, it totally misses the error. It’s literally doing the thing:

If your long-term model is miscalibrated, then you can talk yourself into believing everything is cyclical in a context where everything important is secular.

Yes. In the year of our Lord 2025, we are still acting as if the 2012 price/rent ratio was just briefly back to normal and the increases since then are the next boom cycle.

The paper repeatedly describes rents as stable. But, take a look at Chart 2. These measures are indexed to 2015. Why?

That means that on the chart, home prices and rents begin the series in 1984 nearly 30% lower than PCE prices. Rents have definitely not been stable.

Here, I have simply done 2 things:

I regressed the home price measure in the chart against the 2 other price measures (pce and rents) and I plotted the resulting estimate.

I set the 3 measures to 1 in 1984.

Rents have risen at double the rate of other prices, according to the data in the paper. That’s not stable. That can explain a lot. You should start with the presumption that that should explain a lot! The regression against rent and pce prices has a correlation of 95% with home prices. Rent inflation has more than a 1:1 effect on home prices.

Of course, I should also control for the 2008 credit shock. I did that in some previous posts.

Originally, when I wrote “Shut Out”, and I had noticed that any way you look at data, higher rents are associated with higher price/rent ratios, I speculated on several causes, and I suspected that tax treatment was important. It probably does factor in. But, over time, I have moved toward a different focus. Rent inflation is largely land rent. It is the “bribe you pay to the land” for permission to have a structure in our heavily regulated real estate economy. Land trades at a higher multiple than structures do, if for no other reason than that it doesn’t depreciate. So, every additional dollar of excess rent a home earns increases the price premium on the value of the home, which is a bundle of the land and the structure.

So, the Dallas Fed paper starts with an undeniable fact: housing markets are cyclical. And it ends up assuming that we are at the top of a cycle that requires some reversal, when we aren’t even in positive cyclical territory.

No reviewer is ever going to make the author of a proper economics paper reconsider their assumptions because of my research. The bad news is that this will bias policy economists toward contraction and deprivation. As I pointed out in “Building from the Ground Up”, this was an important error in the assessments of 2008.

The Financial Crisis Inquiry Commission took a single paragraph to dismiss rising rents as a cause of the housing bubble, much as the Dallas Fed researcher did. The FCIC wrote:

American economists and policy makers struggled to explain the house price increases… home prices had risen from 20 times the annual cost of renting to 25 times. In some cities, the change was particularly dramatic. From 1997 to 2006, the ratio of house prices to rents rose in Los Angeles, Miami, and New York City by 147%, 121%, and 98%, respectively.

Those were cities with very high rent inflation. They thought that they were cherry picking the cities where rents mattered the least, but these were actually the cities where rents mattered the most! As I said, ignorance or indifference would be a vast improvement over this.

The good news is that you will be able to reliably trade against them and the banks that consult them, probably forever, I suppose.

There are probably stocks right now that are trading at a fraction of what they are worth because of the universality of this error.

PS: None of this is post was meant to be particularly quantitatively thorough, but it occurred to me that the regression really should have been based on a log scale. So I ran the regression of home prices against rents and pce prices on a log scale. And while I was at it I added in a manual control for the 2000s credit boom and the post-2008 credit shock. Then I aligned the modeled home price so that the cyclical ups and downs are balanced.

The modeled house price is the price that we should expect based on rents and credit conditions. The price would be more than 20% higher if we returned to 20th century mortgage standards. Based on current mortgage standards, this simple regression suggests there is currently a small amount of positive cyclical impulse beyond the price that we should expect to be associated with the rent level.

Am I wrong for thinking this is fairly intuitive? If cities commit to forcing rents up through scarcity then you start baking the trend into the price of *opting out of that* (ie, homebuying for a family) or *capturing that* (ie, homebuying for a landlord).

Especially for somewhere like California where prop 13 only increases the value of getting out of the rental market?

A decline in the "real" home prices could be caused by forces currently not in place in this world. A few I can think of are a Thanos style snap, a more deadly pandemic, a grotesque escalation in deportations, or a massive increase in supply. Of those, I put the lowest probability on a supply increase over the next decade.