December 2023 New Home Sales (and GDP!)

JPow! continues the winning.

4Q 2023 GDP came in at 4.7% - 3.2% real + 1.5% inflation. *chef’s kiss*

Figure 1 shows nominal GDP along with 3 trend lines. I personally prefer a 5% trend. We are well below the pre-2008 trend, and we are less than 3% above a 5% trend from the pre-Covid low point. Honestly, this is as close to perfection for nominal growth as one could hope for. (The 5% trend line is basically set at the pre-Covid GDP nadir. Set it at practically any other pre-Covid starting point, and we are at or below trend.)

There continues to be a debate about supply shocks versus demand shocks, transitory versus monetary inflation, etc. I am firmly in the supply shock / transitory camp.

Most of the discussion is incoherent. Scott Sumner has a couple good recent posts on that. Scott and the market monetarists have the right framework. I do disagree with Scott and some others who have criticized the Fed for letting NGDP get above trend in 2021 and 2022. It wasn’t above my preferred trend, but it was above trend if you consider 4% neutral.

That somewhat arbitrary difference is the fundamental source of disagreement, so the basic argument boils down to how you justify your preferred trend. But, even accepting the 4% trend target, I think the market monetarists are overdoing it, and in the process giving away too much to incoherent interest rate target arguments.

As I have argued, it is ridiculous to argue that a Fed target interest rate of less than 2% in the summer of 2022 was responsible for pulling inflation down from the 10% range back to 2%. The only way that could happen is if inflation was truly, fully transitory. (It was transitory!) To argue that it wasn’t transitory because a 2% Fed target rate brought it down is deeply confused. Does anyone think Volcker could have brought down inflation in 1980 with a 2% target rate?

Scott and some others, like George Selgin, have argued that the Fed should have raised rates sooner and higher to lower NGDP growth in 2022.

Here are the NGDP growth rates over 6 month increments:

2H 2021 11.0%

1H 2022 8.4%

2H 2022 7.1%

1H 2023 5.5%

The Fed target rate was still at zero in March 2022, and was still under 1.5% in June. Yet, NGDP growth fell from 11% in 2021 to 8.4% in the first half of 2022. And it continued to fall. So, their argument is not as strong as they let on. NGDP growth was declining toward a lower rate pretty quickly when the Fed target interest rate was still zero! So, at best, their argument is that raising rates would have brought NGDP growth down to their preferred path more quickly. But, the NGDP growth rate in the 2nd half of 2022 was 4% lower than the 2nd half of 2021. That’s already declining at a pretty fast clip!

I haven’t seen any of the market monetarist Fed critics respond to this point. (Marcus Nunes, over at Money Fetish, offers a perspective on recent monetary policy that I think is closer to mine, and he’s always worth a read.)

I consider the 5% trend to be reasonable, so I don’t have a problem either way. But, even if we stipulate a 4% trend, the market monetarist, NGDP targeting, critique of the Fed is still a bit tricky. If NGDP growth was already declining when the target rate was at zero, why should we assume that the neutral rate was higher than zero?

As I have argued, the Fed did need to eventually raise the target rate because their policy decisions were so successful in 2021 and 2022 that real forward economic expectations improved, recession fears receded, and real long term interest rates rose as a result of that. The rise in the target rate was a lagging indicator of success, not a causal trigger.

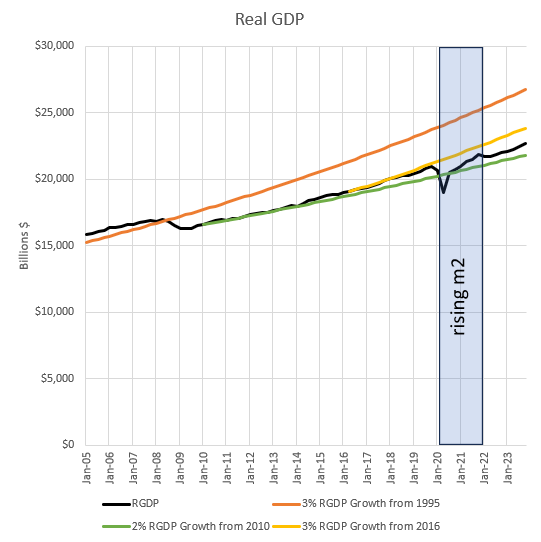

I think Figure 2 and Figure 3 might help highlight what has happened. Here, I divide the NGDP trend paths into an inflation path and a real path. Figure 2 shows GDP price inflation with 2% trendlines. Figure 3 shows real GDP with a 3% trend from 1995, a 2% trend from 2010, and a 3% trend from 2016.

Figure 2 shows that, by any measure, inflation is above trend.

In Figure 3, real GDP growth is above a 2% trend (associated with a 4% NGDP growth trend), but it is still well below a 3% trend. I think it is likely that, if NGDP growth continues along a 5% trend, real growth will catch back up to the 3% trend line and inflation will pull back to the 2% trend line that extends from 1995.

Basically, the housing bust from 2008 to 2016 was associated with a one-time shock to real GDP growth of about 11%. We probably aren’t going to get that back. But, if residential investment can continue to recover from its current levels so that we continue to get back to being a country with unencumbered labor and capital flows, we can at least reattain something close to the 3% real growth trend that we had before 2008.

By the way, we are now into 6 quarters of real and nominal GDP growth that support the expectation of a sustainable 5% nominal GDP growth target. The question to ask yourself is how many quarters do you need in order to concede that a 5% growth path is worth pursuing?

I would argue that Figure 3 makes it clear that it is right to say this is a supply shock versus demand shock debate, and that, for all intents and purposes, it was a supply shock. Real GDP is growing at a 3% rate, but it is still below the 3% trend. We aren’t past the supply shock yet. And each quarter that real GDP remains strong while inflation remains under 2% will be additional evidence in favor of the supply shock school.

Housing is part of this story. That discussion will be below the paywall, along with this month’s new home sales update.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.