The new business cycle: Part 1

A Housing Shortage Reduces Cyclicality

Here I’m going to walk through various aspects of the new business cycle. As with the earlier post on rental supply, I am sort of thinking aloud here, so forgive me if there ends up being an incongruity here or there. This is a market that has changed fundamentally. We have a choice: (1) Learn what that means on many dimensions in real time, or (2) misunderstand every trend in the market because of outdated presumptions. Studying some historical period of housing that shared our current conditions to confidently model today’s market isn’t an option because I don’t think there is a historical precedent to today’s American housing market, and if there was, there isn’t likely to have good data.

I will build the table of contents as I finish the series:

Review of 2008 vs Today (free post from 2024)

Part 1: A Housing Shortage Reduces Cyclicality

Part 2: What about 2008?

Part 3: The Components of Home Price Deviations

Part 4: Migration and the Cycle

A Housing Shortage Reduces Cyclicality

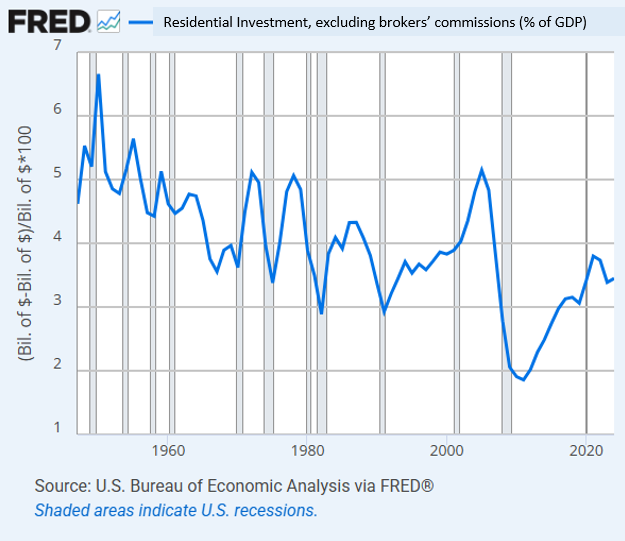

I think that one reason the 2001 recession was relatively light was because residential investment is a leading cyclical component in the economy, and there wasn’t an up-cycle in the 1990s. In previous decades, residential investment would top out at 5% or more of GDP (4.3% in the 1980s) and then decline to 3% or 4% leading into recessions. Residential investment never even recovered to 4% in the 1990s.

By the year 2000, the cyclical process of managing housing expenditures had flipped. In the 20th century housing expenditures were real expenditures. When American incomes cyclically slowed down, American families built fewer homes. By the year 2000, marginal housing expenditures were inflationary - rents on land. In that context, spending less on housing requires building more.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.