Anti-corporate housing

As you all have probably seen, President Trump issued a statement this week on housing:

For a very long time, buying and owning a home was considered the pinnacle of the American Dream. It was the reward for working hard, and doing the right thing, but now, because of the Record High Inflation caused by Joe Biden and the Democrats in Congress, that American Dream is increasingly out of reach for far too many people, especially younger Americans. It is for that reason, and much more, that I am immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it. People live in homes, not corporations. I will discuss this topic, including further Housing and Affordability proposals, and more, at my speech in Davos in two weeks.

I have previously written about the danger of something like this happening. Some progressive senators, including, I regret to say, my two Arizona senators, introduced a bill in the last session that intended to do what Trump claims to want to do.

Under current conditions, the main American housing problem is that we lack millions of homes that would be rental units for households that would form if the homes were there. We desperately need deep pocketed investors to invest trillions in American real estate for those missing households.

Frankly, between the huge scale of the need for those homes and the minute scale of actual large institutional ownership of real estate, anyone who spends 5 minutes looking into this issue and still thinking large institutional investors are an important part of the affordability problem is announcing their lack of seriousness.

In a classic Winnie the Pooh story, Winnie the Pooh and Piglet are hunting for Heffalumps and Woozles – imaginary creatures that Winnie the Pooh fears are stealing his honey. As they walk in circles in the woods, they come upon their own tracks in the mud and become convinced that they have found the trail of the Heffalumps and Woozles.

Last month, in the Atlantic, Annie Lowry wrote that she was hunting for someone to blame for increasingly costly housing, and she came upon the tracks of private equity firms buying single-family homes to manage as rentals. She noted that in majority-black neighborhood in Baltimore – McElderry Park and Ellwod Park/Monument – owner-occupants made just 13 percent of home purchases in 2022. She warned that “investor money is distorting the housing market in communities with low wages and decent-enough housing supply, pushing thousands of Black and Latino families off the property ladder. Tens of thousands of workers who would like to invest in a home are instead stuck paying rent, and putting up with the associated uncertainty.”

Zillow.com tracks home prices and rents in that part of Baltimore, and estimates the typical rent to be $1,634 and the typical home price to be $104,250. At that price, a mortgage with a 3% down payment and a 7% mortgage rate would cost about $694 per month.

Unfortunately, the various pathologies we have unleashed on the American housing market make this point easy to explain. High home prices aren’t preventing families that are paying $1,634 in rent from taking out a mortgage for $694. Homeowners in McElderry Park have an absurd advantage over renters, and being outbid for purchasing a home versus renting a home is definitely not their problem. It’s not even within shouting distance of their problem.

The article mentions that in majority white neighborhoods nearby, large landlords have not been so active. As a comparison, I will simply use Zillow’s estimate of the typical home in the Baltimore region. Zillow’s rent estimate is $1,920 and the price estimate is $394,188, putting the mortgage payment at $2,623 – higher than the rent payment.

The missing piece of the puzzle here is the deep regulatory clamps that federal regulators at the Consumer Financial Protection Bureau and the Federal Housing Finance Agency have placed on mortgage markets since 2008 that prevent families in McElderry from making obviously advantageous financial choices. There is no federal agency tasked with stopping them from renting, but there are agencies tasked with stopping them from buying a home… for their own good, of course.

And, now out of concern for their relative lack of power in the marketplace, legislators across the country are debating whether to also control who can be their landlords… for their own good, of course.

Difficult access to reasonable mortgages is not on Lowrey’s list of challenges contributing to the housing crisis. This is understandable. In the chaos coming out of 2008, economists, policymakers, and pundits have universally failed to see how deeply mortgage access had been scarred relative to decades of norms going back into the 20th century. Lowry notes that there was never a large investor market before 2008. That is why.

Before 2008, in the Baltimore area, more than 8,000 new single-family homes were typically constructed each year. In 2008, it fell below 4,000, where it remains. Why don’t McElderry residents who are outbid by private equity for existing homes buy a new home instead, like they did before 2008? It’s the mortgage access.

Seventeen years later, we’re circling back around on our own tracks. We’re not being followed by Heffalumps.

Lowry suggests that if we can’t ban large scale landlords outright, maybe we can raise their taxes. After we raise taxes on landlords, will we have to go hunting for who’s responsible for rising rents? Oh, look, there’s another set of footprints.

Ironically, the Trump administration has direct control over the one lever that would return the advantage families always had over corporate buyers before 2008 - more reasonable underwriting at the federal agencies and fewer regulations on private banks who would originate mortgages and retain them on their own books. If they are serious about the housing shortage, this will be an important part of the details that Trump says will follow.

Under mortgage standards of the 2000s, 1990s, 1980s, 1970s, etc. there was no large scale single-family rental market. There was a smattering of small-scale mom and pop landlords scattered around older neighborhoods. Returning to those lending standards would make Trump’s announcement about corporate homebuyers less concerning. If that isn’t a part of the larger plan, this proposal would be a disaster for American families - not because those investors are a huge part of the marketplace today, but because they will likely need to be a large part of the building boom it will take to lower housing costs under current conditions.

PS. Trump later announced that he will direct Fannie Mae & Freddie Mac to purchase and hold more mortgage backed securities on their books. As with the other announcements concerning Fannie and Freddie, these marginal changes in where assets are held or who owns them don’t amount to much. These are basically low risk fixed income securities with a lot of close substitutes in capital markets. I don’t think it makes much difference for mortgage rates. Underwriting is the key issue that would change the market.

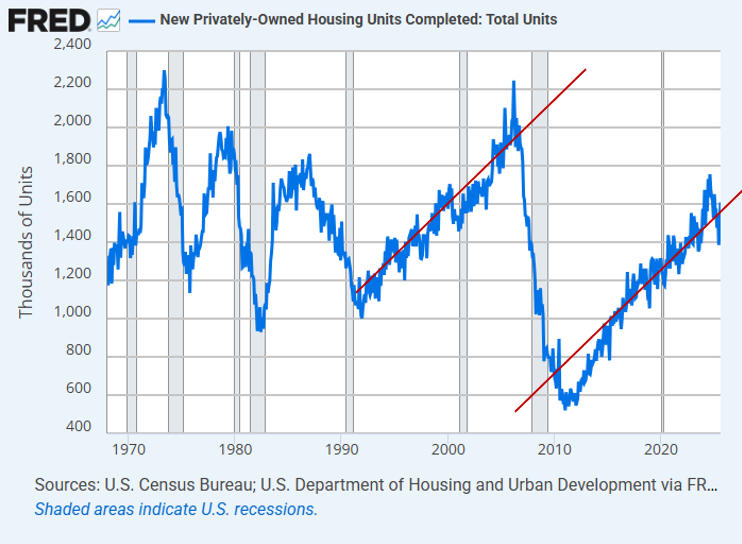

And, even on underwriting, the problem we have is that the shock to mortgage access made such a huge gulf in our capacity to build homes that it has taken years to regain it. Even if we immediately returned to 2002 underwriting standards, the trend in new home completions probably can’t bend much higher than it has been growing for a decade. The important minimum goal is to make sure as capacity grows, we don’t put obstacles in its way. But, I don’t think there is any way to suddenly be completing 2.5 million new homes a year.

Even in the 2000s that everyone thinks produced a glut of homes, capacity growth followed the same path. In the 1970s and 1980s and from 2012 to 2015, there was cyclical capacity recapture that could happen more quickly. More generous underwriting will turn more of those units into owned units. YIMBY reforms will turn more of them into multi-family and in-fill. And, in the meantime, blocking large scale investment in single-family rentals might just stop the linear rise in completions before it gets to a sustainable rate.

This is a great article, I was wondering how you'd respond to the announcements. I also love the Pooh reference 😄 I identify as a progressive but I really take issue with the "all of our problems are caused by greed" story. It seems like everyone needs someone to blame but this seems to me to be a really good example of how it's just a policy that's having these consequences.

Great article, Winnie the Pooh ftw!

Has anyone studied whether the relationship between rents and mortgage prices broadly correlates with rates of corporate ownership? It makes intuitive sense and your anecdote is strong, I’m just curious if anyone has done an analysis across markets

I ask in part bc I wonder if PE housing investment might have risen some amount in certain areas even without changes to mortgage lending standards just bc it’s smart to invest in supply constrained areas. Especially in high-cost places with YIMBY reforms happening, property owners will get an upzoning-induced windfall. I expect lending standards are a much bigger factor, but interesting to think of a counterfactual where we still have pre-2008 lending standards but PE investment still occurs to a lesser extent