Transitory Inflation, another review

I would like to make or reiterate 3 points:

Rate hikes didn’t bring down inflation. (They didn’t have to. It was transitory.)

The trend in M2 can’t salvage point 1.

The expectations fairy can’t salvage point number 1.

I’ve made the first point many times. The basic point is that you don’t bring down 7% inflation with a 1.25% interest rate target.

M2

I have seen some economists point to M2, shown in Figure 1 along with personal consumption price index. The M2 measure of the money supply peaked in April 2022. So, monetary policy surely was responsible for contracting the money supply, and surely a contracting money supply was responsible for lower inflation. As shown in Figure 1, the price trend sharply flattened from a double-digit run rate in June 2022 back, permanently, to a much lower rate. Inflation has approximated 2% (once you account for the well-discussed lag in measured rent inflation) since then.

All of that is true. The peak in M2 could be a sign of monetary tightening and it happened a few months before inflation shifted down.

But that confirms that inflation was transitory. In April 2022, the Fed Funds rate was still approximately zero.

The way the theory of interest rate targets work is that the Fed pushes the short term interest rate down by injecting money into the economy, which is inflationary, or it pushes the short term interest rate up by withholding money from the economy, which is deflationary.

So, the drop in M2 after April 2022 must have been associated with a short term interest rate pushed artificially high. The rate was zero. The only way that a zero rate could be associated with declining M2 is that forward inflation expectations were negligible.

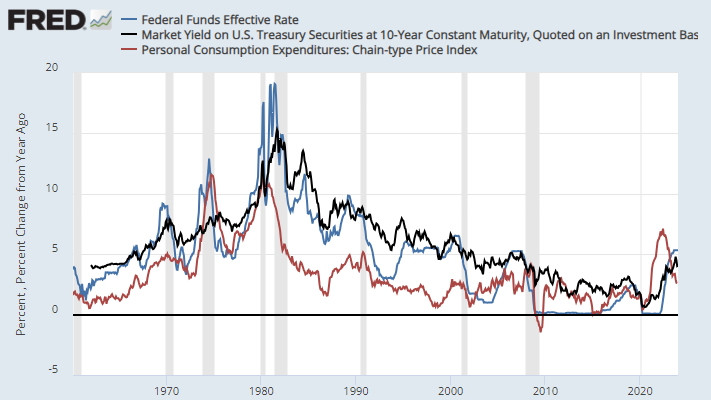

Figure 2 shows the long term relationship between inflation (trailing 12 month), the Fed Funds rate, and the yield on 10 year Treasury bonds. Almost all of the time, the Fed Funds rate is well above inflation. When the Fed Funds rate was at zero after the Great Recession, inflation averaged around 2%. And, during that time, the yield on the 10-year Treasury was still above the inflation rate.

In April 2022, the yield on the 10-year Treasury was about 2.75%. Based on these long-term relationships, when M2 peaked, forward inflation expectations were surely 2% or less.

The decline in M2 at the prevailing interest rate of the time confirms that inflation was transitory and capital markets knew it. The only way that M2 could have declined after April 2022 is if the neutral short term interest rate was below 0%. The only way that could be the case is if inflation was very low.

Expectations

Some try to use expectations to plug the gap. It isn’t just the current rate target that determines monetary policy. It’s expectations about future rate trends. The Fed was signaling that they would raise the target rate. Those expectations could lead to slower growth and slower inflation.

Figure 3 shows a close up view of Figure 2. The 10-year yield provides a clue about future rate expectations. By June 2022, it was still only 3.14%. It briefly touched 4% later in 2022. There was never an expected rate target high enough to lower inflation of more than about 2%. Any inflation above that was transitory. And the expectations channel confirms that it was transitory.

Figure 4 shows the forward rates on 3 month Eurodollar contracts (which are a short term rate that tends to run a little bit higher than the Fed Funds rate). The expected short term rate was about 3.5% in April 2022, and it was still about that high in June.

Later, after transitory inflation was over, when the Fed continued to raise rates, those high rates were transitory, because they came well after transitory inflation had ended. There wasn’t even a pretend reason for them, and so they were expected to revert quickly back to a neutral level.

In that case, I think expectations helped. Since the extra hikes were never expected to hold, they didn’t affect the cost of borrowing that much, outside of a few markets that deal in the very short term. (The average outstanding bond usually has a duration of more than 6 years.)

Just to be clear, I think there is an expectations channel. But I also think it is easy for it to be a sloppy kludge that can explain everything. It can’t explain the decline in inflation in 2022, but many economists are still trying to use it as an explanation. And, they are demonstrating how it can be a sloppy kludge that can explain everything. Something that can explain everything will prevent you from understanding anything.

As with M2, the main point is that the target rate levels that were expected when inflation suddenly downshifted in the summer of 2022 confirm that inflation was transitory, because even expected rates were never remotely high enough to bring down inflation much higher than 2%.

Scott Sumner, as usual, is way ahead of the conversation:

I still say that monetary policy is not tight, just a bit less loose than back in 2021 and 2022. People have consistently put too much weight on interest rate increases, but as Larry Summers recently pointed out, the neutral rate is probably higher than we’ve been assuming:

“Former Treasury Secretary Lawrence Summers said the economy’s enduring strength in the face of vigorous Federal Reserve tightening makes it increasingly likely that neutral interest rates have risen.”

As I have mentioned, I just have a marginal disagreement with Scott. I think we have nicely glided back near a 5% nominal GDP growth track, so that I don’t think the Fed was ever really loose. They were loose in 2021 and 2022, but that was looseness with the goal of reattaining the long-term growth trend. And I don’t think they are loose now because we are basically following that trend.

The 2021 and 2022 inflation was transitory because it was due to supply shocks, and Fed policy plus fiscal stimulus were only associated with inflation because of that supply shock. The Fed shouldn’t try to counteract supply shocks. So, the high inflation wasn’t their fault, it didn’t need to be addressed, and it went away on its own.

Anyway, I think Scott and I agree on the basic framework (which I learned from him). But, we just disagree on what the appropriate trend is.

Larry Summers has been famously wrong about a lot of things, but I think he’s right in the above quote. And, in fact, this is something that was clear all along. I think the first time I mentioned it was July 2023, and I feel like I was really slow in realizing the obvious.

One important reason that long-term rates increased in 2022 was because the Fed didn’t try to quell transitory inflation, and so future economic prospects improved. Summers is only now coming to the conclusion that the neutral real rate has risen. But, the neutral target rate was probably already rising in 2022. In fact, the Fed never really tightened at all. They were just following the neutral rate up, for the most part. It helps to be able to see that when you realize that they never had to tighten and their tightening could not have possibly brought down inflation.

The neutral rate increased in 2022. The Fed followed it up. And, I think they eventually overshot it, but the fact that their patience in 2022 allowed it to raise meant that overshooting wasn’t as deflationary as it could have been.

The 10-year rate started rising ahead of the Fed’s rate hikes. The Fed was following expectations higher, not the other way around. But the expectations kludge is only applied the other way around. Since it explained everything, the likely explanation was not a visible option. Over time it is harder to miss.

Welcome to Team Transitory, Larry.

PS. It looks like, just as I published this, Neel Kashkari, the head of the Minneapolis Fed, has also joined Larry Summers in concluding that the real neutral rate has increased. And, he links to some previous essays in which he also was taken in by the expectations kludge - thinking that forward rates were rising because the Fed was promising to be hawkish rather than because the Fed was being commendably dovish.