Every time I think I’m out, they drag me back in.

Biden’s Council of Economic Advisers has attempted to quantify the costs of the supposed RealPage apartment cartel, so I thought it might be helpful to visualize their conclusions.

I will accept their findings at face value, but as I have written before, these complaints have many problems, including these: The idea of how this cartel could function over the long-term is incoherent since it lacks the power to limit construction of new apartments. Even where the software might raise the average rent, it could be discovering the market price rather than deviating from it. And it also almost certainly sometimes leads to lower rents. We are currently in a condition with very low vacancies. It is especially odd to push a theory of market collusion now that depends on holding additional vacant units.

According to the CEA, users of the software increase their rents by an average of 4%. This increased rental expenses by $3.8 billion in 2023.

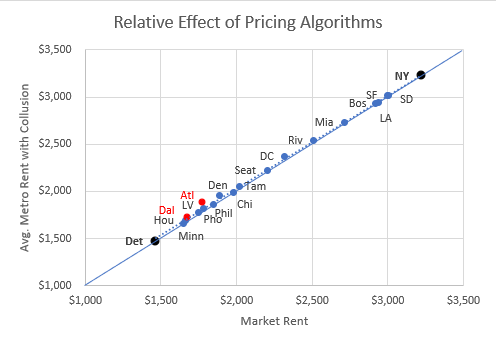

Using their numbers and Zillow data (which I think they also used), Figure 1 shows their estimate of what the typical market rent for these 19 metro areas would be if no landlords used the software, on the x-axis. It shows rents with the current use of the software, on the y-axis.

So, the effect of the software on the local market is shown by the distance between each city and the 45 degree line. All other factors leading to higher rents account for the vertical distances between the cities. As a rule of thumb, you could consider the distance between, say, Detroit and Dallas to be a decent reflection of different demand. The distance between New York City and Dallas is a reflection of local supply constraints enforced by municipalities.

I have highlighted the metro areas where the CEA found that pricing algorithms have more than 50% market share in red (Atlanta and Dallas) and the metro areas where pricing algorithms have less than 10% market share in black (New York City and Detroit - Yes, both the most and least expensive metro areas).

Here’s another way to think about it. Tenants spent $676 billion on rent in 2023. The CEA estimates that algorithms were responsible for $3.8 billion of that.

Excess rent inflation has accumulated to more than 40% of rental expenditures over the past few decades. Without those decades of excess rent inflation, total rental expenses for the rental stock we currently have would be $479 billion instead of $676 billion.

Figure 2 allocates the $197 billion in excess rent among three sources.

Pre-2008 apartment obstruction, which was mainly regional, in New York, Los Angeles, San Francisco, Boston, etc. That accounts for 38% of excess rent.

Post-2008 excess rents, which have spread across all cities because of the combination of mortgage suppression and apartment obstruction, so that every city is now undersupplied, with low vacancy rates, regressive rent inflation, etc. That accounts for 60% of excess rent.

The asserted effect of algorithms, which the CEA estimates at $3.8 billion. That accounts for 2% of excess rent. (This is the segment in Figure 2 that resembles a thick line at the top of the column.)

The irony is that the White House is largely in charge of the mortgage agencies that have added $118 billion in rental expenses since 2008 by creating a construction depression. But instead of dealing with that, they are harassing private firms over $3.8 billion, based on questionable theories of market control.

The Biblical speck of dust vs. plank in your eye story is supposed to be hyperbole, people.

The CEA analysis has received some media coverage, such as from Judd Legum at “Popular Information”. He notes that several cities have been passing legislation banning the use of the algorithm. Hilariously, given Figure 1, these include San Francisco and San Jose.

Legum reports, “Legislation has also been proposed in San Deigo by the city council president, the Markup reports. Rents in San Diego have increased by 21% since 2020. That follows a 26% increase in the city rents from 2017 to 2020. According to the CEA report, renters in San Diego pay $99 more per month as a result of landlords using RealPage's AI price-setting tool.”

Now, the $99 is the CEA’s estimate of the extra rent only for the 22% of the San Diego market that uses the algorithm. The market penetration of the algorithm is quite low in all the most expensive markets. And, the rent increases Legum mentions mean that the typical rent in San Diego, 78% of which is not influenced by the algorithm, has gone from under $2,000 in 2017 to more than $3,000 today. The algorithm is asserted to be responsible for 2% of the change in rents in San Diego since 2017.

It’s hard to infer that scale from Legum’s reporting because of his mixing of percentages and numbers. The CEA report suffers from the same problem. I’m sure in both cases, it was the best they could do in a sincere attempt to convey the scale of the problem in the most informative way they could think of. I’m hopeful that they will appreciate my efforts in that regard.

The comments to Legum’s post are a pit of anger. Seth Hathaway writes, “Late-stage capitalism. When is enough enough?” NubbyShober writes, “When venture capital started buying up masses of foreclosed houses and apartment buildings during the Great Recession, the large-scale gouging of renters by Wall Street became an inevitability.”

Boy, if we could get these folks 50 times this worked up about the causes of high rents that are 50 times more important than RealPage, we could eliminate homelessness by Tuesday.

There is an unfortunately large portion of the population who are able to concoct a sense of data out of thin air to become predictably angry at predetermined scapegoats. For some it’s immigrants. For others it’s corporations. There are many forms of this mental disease. I’m afraid that we are currently at a moment where these various groups of people together are the majority, and at times like 2008 they find common cause, to the detriment of the rest of us and the most vulnerable of us.

I’m not sure there is a single line in the “Popular Information” post that you could call misinformation or a lie. He’s strictly reporting the legitimate findings of a CEA report. And yet it amounts to nothing but hysteria, mistrust, and another block in the wall of an angry, unproductive world view. A thousand concocted blocks, none of which need to be any more empirically robust than this block is, all holding up a paradigm of anger. “Private equity or corporations are always doing stuff like this.” And by “stuff like this” they mean rotten things that corporations may or may not be doing, but that the speaker will believe with little to no evidence in any case.

I mean this sincerely. Anyone who has worried about the RealPage cartel should drop it immediately. But that isn’t enough. They also need to do an inventory of all their other economic beliefs, because their beliefs are likely riddled with biases and prejudice which make them routinely unreliable. The software lacks the capacity to create oligopolistic pricing on so many margins, you would have to be deeply committed and practiced at not thinking carefully in order to think it was important.

There are a lot of people, even in the YIMBY movement, that are susceptible to this. They will take a “Why can’t it be both?” position. Why can’t we fight both the rent setting cartel and zoning?

Why can’t we fight both witchcraft and pathogens?

I don’t know. Maybe people who are better than me at understanding politics know that you do have to “fight” both witchcraft and pathogens to realistically gain support for progress. AITA?

One of my fears, which I’ve stated before, is that there must be a very strong overlap between anti-RealPage people and people who would ban buying activity of private equity or large for-profit institutions in housing markets. That concern is as trumped up as the RealPage issue is, and I believe that it would be the final disastrous policy error in housing leading to outcomes I don’t even want to imagine.

The only solution is to ban the Internet, or at the very least, prohibit landlords from using it to collect and collate data of any sort. Which means that they can't be allowed to use spreadsheets either. Or telephones, because that could also result in collusion.

Meanwhile, back in the world of housing construction suppression the Supreme Judicial Court in Massachusetts upheld the MBTA Communities Act which in theory is a win for housing multifamily housing in the Greater Boston area. However, the ruling also requires the Legislature to re-write the guidelines that towns have to follow. The actual result of this will be another regulatory slow-walk that will probably result in more poison pills in local zoning ordinances that will prevent any meaningful development in rich towns.

I think that what the activists and politicians are doing is more specifically scapegoating real page for a shift in market information structure. Real page is a great example of how landlords now have access to much better market price information and an unmeasurable part of the increase in excess rents is based on that improved information as rent information moved from classifieds to Craigslist to Zillow/apartments.com to real page. Meanwhile it’s also the boomer/silent generation of landlords and property managers who have been retiring/selling and are being replaced by more finance minded landlords who take more risk to maximize rent collected.

A lot of the naturally occurring affordable housing is what filtered down while being owned by small landlords and when they sell it’s going to people/firms who are going to renovate it back up at least to the market median and some of them will be using real page to make those determinations. Its pretty easy to walk around a block by me and identify what has filtered down, what’s was turned into a median condo, what’s been renovated back to close to the top of the market and whats had a bad job done renovating and is going to cycle through renters who realize they overpaid every year and the landlord is fine with that business model.