Housing and Inflation, July 2024

Soft landing alert! JPow! winning.

Same old story.

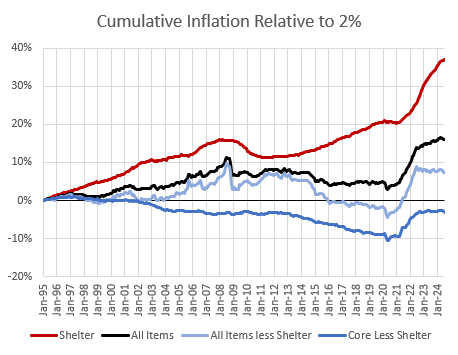

Inflation has been low the last couple of months, but I’m not quite ready to yell “deflation” in a crowded trading pit. I think Figure 1 is the best way to see recent inflation trends. This shows the trend of several inflation indexes, relative to a 2% annual baseline. Basically, all the excess inflation over the past 30 years has been rent inflation. (And rent shouldn’t be included in indexes that inform monetary decisions.)

In 2021 and early 2022, there was a one-time jump from transitory inflation related to Covid upheavals. That disappeared quite sharply in the summer of 2022. Shelter inflation has been rising for most of the past 30 years. That pulls the trend up on aggregate CPI inflation. Excluding shelter from both the CPI and core CPI, they are both flat as a pancake for 2 years now.

We are well into a soft landing, and I think the Fed still has a decent amount of wiggle room in the speed at which they lower rates, though I am glad to see expectations of Fed loosening over the next few meetings.

The yield curve (Figure 2) is almost exactly where it was after the last FOMC meeting. I like this shape. It suggests that the Fed will be sharp enough with rate cuts to get ahead of bearish sentiment changes. The long end of the curve is nicely positively sloped.

What we don’t want to see is the entire curve declining. Industry insiders and orthodox macroeconomists will consider that bullish, because they act like causation goes entirely from lower rates to capital investment. But, that would be bearish. Before Covid, the Fed had been right on the edge of that tipping point. Usually, in past cycles, they followed the neutral rate down into a recession, never injecting enough cash to get out ahead of it. They were especially bad about that before the 2008 crisis.

In 2019, the Fed was close. I think it is a toss-up whether they would have avoided a monetary recession if Covid hadn’t hit.

Today their job is easier, because the new home construction market is naturally set up with millions of units of pent up demand. It is still constrained by supply chain capacity, so that as capacity loosens, construction activity will grow, regardless of moderate changes in aggregate nominal incomes. And, all of that is in as good of a position as it is because JPow! has masterfully steered the ship thus far.

What we should want to see is the yield curve remaining within that May 28-August 2 range. There is a natural trade here to be long on undervalued homebuilders. If yields go lower than the August 2 level, especially if the slope of the curve levels out and it is accompanied by a lot of bearish economic news, then that trade might have some headwinds. I doubt there will be any reason to drop the homebuilder position, but possibly some hedges protecting against a downturn would be in order - a long bond position or something. For now, I don’t see a need for that, but it might be too late for it by the time I do.

Inflation expectations from TIPS spreads (Figure 3) have taken a sharp downturn recently. Near-term expectations (5 year) are below future expectations (5 year, 5 year forward). That’s a sign that the Fed has let policy get a bit too tight. Both should be around 2.25-2.5%. But, taking the longer view, this is not yet a problematic sentiment, as long as the Fed is attentive to some timely loosening over the next few meetings.

Monthly inflation continues to basically look like the pre-Covid trends (Figure 4). Aggregate CPI will hit around 2% because non-shelter CPI will be below 2% and the shelter component will be above 2%.

Shelter inflation is still a bit noisy. (Here, I use the Zillow ZORI estimate, because the CPI shelter measure has methodological lags and isn’t currently very informative.)

Shelter inflation is running higher than CPI inflation excluding shelter. Before 2020, ZORI tended to increase by about 4% annually (which equates to a bit above 3% CPI shelter inflation). It’s hard to see where it might be settling in now. Recent prints suggest that the annual ZORI is a little bit lower than 4%. So maybe the stability of new home completions since Covid has helped move excess rent inflation down a bit. At 1.5 million units annually, we are still below the sustainable pace that would put an end to excess, regressive rent inflation, but maybe we aren’t quite as far below it as we were before 2020.

Figure 5 shows the cumulative rise in excess rent inflation since January 2015. Maybe the slope of that cumulative rise is already lower than the pre-2020 trend. Maybe the it isn’t just returning to the linear trend from the 2022 bump. Maybe it’s permanently crossing under it. Maybe excess rent inflation is at a lower run-rate now. That would be great. Though, of course, we still need to get to work on the 20 million additional new units it will take to reverse 30 years of accumulating land rents.

And, finally, Figure 6 compares Zillow estimated home prices (ZHVI) and rents (ZORI).

This is just a poor-man’s correlation check. I just manually line up the ZHVI and ZORI trends from 2015 to 2019, and check for any divergences since then. There have been few. Prices are almost entirely driven by rents, but prices rise by more than a 1:1 ratio as rents rise. They are still climbing the 2015-2019 trend together.

Rents are where they are because of transitory inflation in 2021 and 2022, plus 30 years of supply constraints. Prices are where they are because of rents. The only way prices are going to correct back down from this is by constructing millions of new homes.

Just a few details below the fold for subscribers.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.