Have rents stopped rising?

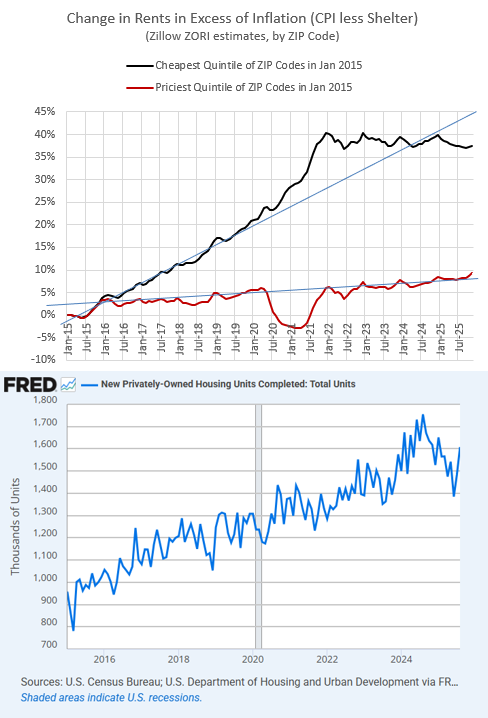

In the previous post, I wrote about the top panel of Figure 1. My point was that there is just no getting around the issue that rent inflation has been much higher for families with lower incomes than it has been for families with higher incomes. Our current set of publicly administered statistics aren’t set up to capture this. So, the problem is significant and is not easily discussed with conventional statistical tools.

Yet, while it is a big problem, it also appears that the problem seems to have, at least, stopped getting worse since 2022. Has it? Are rents starting to correct?

The bottom panel of Figure 1 shows new home completions. Completions increased a lot from 2015 to 2024. So, has new supply risen enough to flatten out rent inflation?

In 2015, we were building about 1 million new homes annually, and excess rent was adding 2% annually. Let’s call post-Covid completions 1.6 million annually, and rents have flattened out. Could 600,000 new homes annually have been enough to flatten rent inflation?

There are about 150 million homes in the United States. A decent estimate of housing demand elasticity is that a 1% increase in supply should lower prices by 2% (elasticity is 0.5). That would imply that we need about 2.5 million new units annually to flatten out rent inflation (1 million in 2015 + 1.5 million to bring rents down).

If an additional 600,000 units lowered rent inflation by 2%, that implies demand elasticity of 0.2 (a 1% increase in supply lowers rents by 8%). That seems a bit too inelastic to me, though demand elasticity is highly context specific in housing, so it is easy to have intuitions that are off. If I claim that the supply shortage has led to 38% rent inflation in low tier neighborhoods an 9% in high tier neighborhoods, then some basic math suggests that across the neighborhoods of a given city ranges from something approximating 0 to 1. What’s the neutral building rate?

I discussed this a bit in my descriptions of my Metro Area Analysis Packages. Will rent inflation be flat (no higher than general inflation) going forward at current completion rates, as it has been for a few years?

Discussion below the paywall.