There is a type of article that is increasingly showing up, about the coming tsunami of supply and collapsing rents. These articles tend to come from industry publications. Because of the array of NIMBY obstructions, developers and builders have to exist in a marketplace characterized by political constraints. This adds risk, since a change in those constraints will change the marketplace.

Housing should be much less expensive, and so landlords and builders are always in fear of the loss in the value of their land investments which they know would come if political obstructions to construction were lifted. They also know that if those obstructions were lifted, competitive forces would drive them, as a group, to create more housing and ruin the value of their assets.

They don’t like that idea, and they know that they would be powerless to stop it. So, industry journals tend to run stories where declining rents is bad news. And, anecdotes or idiosyncratic local data are frequently cited that claim some large amount of new supply has suddenly dropped rents by something like double digit percentages.

I suspect that this reflects a combination of sincere, but overblown, fears, and conscious or unconscious signaling intended to scare away other producers. It is tempting to cite these stories to rub NIMBY noses in the evidence of supply leading to lower rents. And, it is good evidence that developers and builders understand the power of supply and their own inability to collude to prevent its production.

But, I would caution against relying too heavily on the numbers. They are almost always unrealistic and overstated. There might be a project here or there with unexpected vacancies or deep rent cuts. And there might even be shocks to demand that lead to those outcomes (a deep recession in a local industry, Hurricane Katrina in New Orleans, etc.). And, there could be many properties where the financials for the current owners don’t pan out. But, there is no realistic amount of new supply that is going to cause rents across a whole metropolitan area to decline by double digit percentages in a single year.

Housing demand is inelastic. Each 1% increase in supply probably reduces rents by something close 2%. That would be a very effective supply response! But let’s think about what that means.

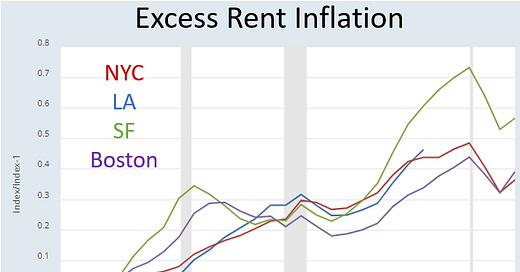

Here is excess rent inflation for the Closed Access cities. They generally allow the housing stock to grow by less than 0.5% annually. They have generally averaged about 1.4% excess rent inflation annually since the mid-1990s. If they had let housing grow by something closer to 1.5% annually, they might have avoided excess rent inflation altogether and remained affordable.

(By the way, as I have argued before, I think this is probably roughly true. The Closed Access cities aren’t really superstars. They wouldn’t need to grow like Austin to be affordable. Even matching Kansas City or Oklahoma City might suffice to solve the housing problem. San Francisco is the exception, though even San Francisco might have remained affordable at growth rates near or below Austin’s.)

Other cities have a range of growth from slightly negative to about 3% in recent years. So, for instance, at the extreme, let’s say Austin keeps building for 3% growth but population growth grinds to a halt. Then, Austin might hope for 6% annual rent deflation. That is a highly unlikely maximum supply response. In most cases, we might hope that population rises by 1% while the typical city permits housing expansion at 2% for a while. That would be a rate of housing production well above current levels. And if that happened, nationally, rents might be roughly level (2% less than a 2% general inflation rate). The most likely YIMBY win is probably to hope for a couple of decades of that.

I think we can roughly describe Phoenix this way. Population growth there had generally be 3% to 4% before the Great Recession. Since the Great Recession, it has been more like 1% to 2%. And, I think we can basically attribute that to the housing supply shock. Before the Great Recession, rent inflation was normal in Phoenix. Since the Great Recession, excess rent inflation has tended to be about 4%. That is because there has been a permanent 2% drag on housing growth.

Phoenix is one of the places where industry insiders are fearful that a coming deluge of supply will cause massive declines in rent. Outside of some localized anomalies or very short term volatility, it just isn’t going to happen. The supply pipeline isn’t even as strong as it was in 2005. We didn’t have massive rent deflation in 2005. We aren’t going to have it in 2024.

Going from 5% annual rent inflation to neutral rent growth will still be disruptive. There will be a lot of projects that don’t perform as they need to. There might even be short periods where land prices are sticky or other elements are slow to adjust to keep the flow of new projects coming. Let the developers worry about that. In the long run the demand is there and the cash flow is there and someone will build if the cities make it legal to.

That means you should be careful about where you invest your capital in the real estate market, but you shouldn’t let that affect your opinions about housing justice or your theories of macroeconomic trends. There is not going to be a massive drop in rents followed by a real estate capital strike.

Definitely rub NIMBY noses in the fears developers and landlords express about new supply. Avoid taking the scale of those fears too literally.

Oh, and by they way, if supply won’t solve the cost problems in the expensive cities, as some NIMBYs and skeptics argue, then that means demand is much more elastic and you definitely shouldn’t worry about collapsing rents in cities that build more. The “supply won’t help” and the “supply will lead to a wealth shock and a production shock because rents will collapse” are both extreme errors in the opposite direction from reality. They are both wrong. Don’t believe either. Especially don’t believe both at the same time.

> The “supply won’t help” and the “supply will lead to a wealth shock and a production shock because rents will collapse” are both extreme errors in the opposite direction from reality. They are both wrong. Don’t believe either. Especially don’t believe both at the same time.

That reminds me of the people, common in the 2010s, that argued that inflation would permanently be below target and that central banks 'printing' money won't make a difference:

If that really were the case, your central bank, say the bank of Japancould just one-by-one buy up all the assets in the world at no real cost to Japan.

You see fewer of those people nowadays.