Upside Down CAPM and the trade deficit

Scott Sumner has a nice post about the trade deficit. Here’s the gist:

A current account balance merely reflects the difference between saving and investment; there’s no reason why it cannot continue indefinitely. It may be associated with excessive borrowing, especially excessive government borrowing, but that is not always the case. (Australia tends to have small budget deficits.)

The US current account deficits are probably caused by the same sort of factors that explain current account deficits in other English-speaking countries: low saving rates, highly productive capital investments and high rates of immigration. I see no evidence that the dollar’s role as a reserve currency plays much of a role, unless you believe that the New Zealand dollar is also an important reserve currency.

There is a lot of just-so story telling about the trade deficit being about manufacturers moving to low wage regions, currency manipulation, etc.

The way I would put it is that Americans are very good at making investments, and we make some of those investments in foreign countries. Also, since we are leaders in the post-industrial economy, a lot of the services we sell and digital products we produce don’t have to be put on a ship at a port. Their value comes from intellectual production in the US, but the products are sold at high margins from foreign subsidiaries of American corporations.

So, we end up with a lot of foreign profit.

There is some evidence that, since the US has had unusually high corporate income tax rates relative to the rest of the world, profits might be reinvested more rather than be repatriated, and flexibility in accounting may lead to more profits being claimed in low-tax regions. But, it is obvious with a quick glance at any list of the corporate leaders in new and growing sectors that American firms lead the pack, by a large margin, in global profits on new, growing industries.

So, we have a lot of profits in foreign currencies, and we use those profits to buy foreign goods and services.

In a developed economy, labor gets high wages and capital gets to keep a little off the top. We’re a rich, successful country, so we box above our weight on the capital side. We own capital in other countries that produces more and profits more than what foreigners own in the US.

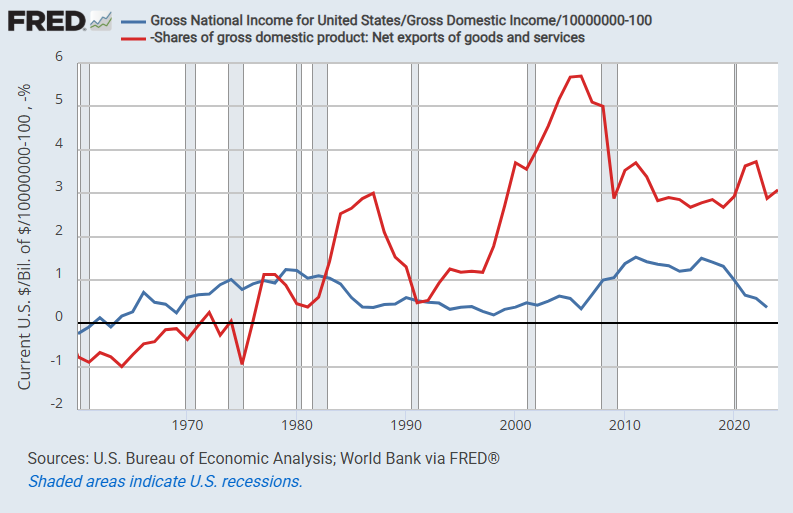

Figure 1 shows the relative size of US national income (which includes net foreign income) to US domestic income (which does not) versus net exports as a percentage of GDP.

Much of the remaining gap between the trade deficit and our foreign income comes from capital flows.

Americans own about $35 trillion in foreign assets and foreigners own about $60 trillion in American assets. We both return about $1.5 trillion of profits annually from those assets. Why is that? Because equity earns higher returns than fixed income. Americans largely invest in corporate assets. Foreigners largely invest in fixed income.

Now, let’s say that we both reinvest some of our profits so that next year’s foreign profits are 3% higher. Americans would have to reinvest about $1 trillion of our foreign profits back into our foreign assets. Foreigners would have to reinvest about $2 trillion of their American profits back into American assets. In order to cover that difference, they have to sell us $1 trillion worth of stuff this year.

They have to keep a trade surplus with us just to keep up with us. They are the ones on the financial treadmill running just to stay in place. That’s why we have had a trade deficit for decades while the dollar remains strong. We’re good at investing and risk-taking.

As Scott wrote, the trade deficit is just the other side of that capital surplus. The difference between investment and saving. That’s just an accounting identity. But, some people want to make it a causal story. We are reckless borrowers, and we recklessly borrow a lot through the federal government, and we use that borrowed money to buy imports that we can’t afford.

It’s just not true. It’s not true that we can’t afford them, and it’s not true that the federal debt leads causally to a higher trade deficit (at least not in this way. More on that below). Look at Figure 1. The late 1990s saw the most aggressive rise in the trade deficit that we have seen in the last 50 years. What was happening in the late 1990s? We were running a federal budget surplus! And, the economy was as strong as it’s been in my lifetime.

We were importing because the tech revolution was producing a lot of foreign profits for us.

The Upside Down Capital Asset Pricing Model

The Capital Asset Pricing Model (CAPM) says that you can get a low fixed return (like on Treasuries) or you can get a higher floating return for taking cyclical risk (like on corporate equities).

I say that you should turn that upside-down. It turns out that total expected real returns on diversified at-risk assets like equities have a strong mean reversion to about 6%. One year it might be +26% and the next year -%14, but over time it tends to average about 6%, and at any given time, the basket of equities are priced as if a return of 6% + inflation is what you’ll get.

I don’t have a theory for that. It’s just what the data happens to reflect.

So, instead of starting from zero and adding risk-free and at-risk premiums up to estimate return on assets, I say start at 6%. That’s what any bozo can earn by free-riding the positive externalities of all the corporations working hard and competing against each other, if you can manage to get yourself to buy a big index of stocks and ignore it for 30 years. (Of course, real shocks change that return over time, especially over shorter periods of time.)

Then, think of fixed income as a service from the borrower to the lender. They will promise you some lower return and you don’t have to worry about that return changing after you put in your money.

Equities expect to earn 6% returns ex ante that end up being all over the place ex post. Fixed income has expected returns that move all over the place ex ante but are fixed ex post.

So, I think the way to think of capital markets is that they are two barbells. At-risk capital funded by the investor at one end. Deferred consumption of the saver that will be funded in the future by today’s borrower at the other end. Capital markets are dominated by those two poles.

Utilities, for example, are in 2 businesses. Electricity distribution is one service. Deferred consumption is another service. Because their extensive asset base has predictable enough future cash flows, they can provide the service of deferred consumption; they can sell bonds.

The US government is the world’s number 1 supplier of deferred consumption. When savers want a lot of deferred consumption (because they are nervous, or aging, etc.) they will pay a high premium for deferred consumption. That premium is subtracted from 6% (+expected inflation) to establish the current interest rates on Treasury bonds.

That’s added value in the world. Why wouldn’t we provide it? The US government makes a massive profit from that. We don’t record it as profit, because the accountants don’t turn CAPM upside-down like I do. So, they act like the interest the government pays on Treasuries is a cost measured by its distance from zero instead of a profit measured by its distance from 6% (+inflation).

So, looked at this way, the federal deficit does fund our import spending. Instead of taxing American citizens from their productive activities, the government earns a profit on its productive activity - providing the service of deferred consumption.

Since the profits it earns from that service allow it to lower its taxes on Americans, Americans put that capital to work. Just like with all of our incomes, we spend some and we invest some. Since this is a bonus we get to keep because our government provides the service of deferred consumption to some foreigners (and to American savers), we have extra capital that we can invest in foreign markets.

And since Americans don’t mind taking some risk, we invest it in at-risk foreign capital and pocket our 6% (+inflation). We’re winning, coming and going. And the imports are our just deserts.

Now, this doesn’t mean that we shouldn’t worry about the national debt. A utility should worry about issuing too many bonds. The government can only provide the service of deferred consumption if it keeps its obligations below its ability to fund them. And nobody knows exactly what that ability will be.

When Scott says the trade deficit is from the mismatch between our saving and our investment, think of it as Americans providing one service (borrowing from savers) and funding foreign investments with its profits from that service.

This isn’t profligacy for which the bill will come due some day. Collectively, we’re like the utility company. We’re the producer on both sides of this equation, and we can profit from it indefinitely.

I suppose it isn’t impossible for us to use the proceeds of the federal debt for profligacy, but there is a really easy way to tell if we are. The value of the dollar would decline against other currencies. It has been fine for decades, and there is no reason to think that will change. (Well, there is currently one reason.)

Go for Growth

This creates a sort of win-win situation for us, as long as we make sure not to elect a Congress and President who lose the trust of the world’s savers. (How hard could it be to avoid doing that!?)

When growth expectations are low or the need for deferred consumption is high, the premium for it is high (interest rates are low) and the government rakes in lots of profits. (Or as those pesky right-side-up accountants would tell you, our interest payments will be low.)

But, if growth expectations are high and the public is investing rather than saving, then growth also tends to follow. That helps everyone, especially those with equity investments. It makes the ex post shocks to our domestic and foreign equity investments positive.

In the 1990s, interest rates were high and growth was high. The trade deficit was rising and the government budget was in surplus.

After 2008, interest rates were low, growth was low, and the mortgage crackdown knocked $5 trillion out of American balance sheets. The trade deficit declined and the federal debt ballooned.

How could those two sets of trends have been associated with 2 different time periods? The Upside-Down CAPM is how.

Hope for a large trade deficit and high interest rates. That means we’re doing all of this right.

There's an opposite force here too, however. USA stocks pay a lot less dividends than foreign stocks. Since dividends is counted in current account, and selling stock isn't even counted in the CA, this would actually mute the USA CA deficit, as domestic investors would make relatively more dividends from foreign stocks than foreign investors would make from USA stocks.

I can't imagine it's big enough to offset the profit gap you point out (buybacks are ~$300B and foreign investment is 15-20% of the stock market), but it might explain part of it.

Interesting piece, thank you. Do you understand why the return on investments by foreigners into the USA is so low?

Example: row 40 of table 1 here (https://www.bea.gov/sites/default/files/2025-03/intinv424.pdf) shows $15.8T of direct equity investments.

Meanwhile row 26 of table 4 here (https://www.bea.gov/sites/default/files/2025-03/trans424.pdf) shows $296B of direct equity investment dividends + retained earnings in 2024. That's only 1.87% or an implied 53x P/E multiple. How does that make sense?