The 2023 Market Compared to 2006

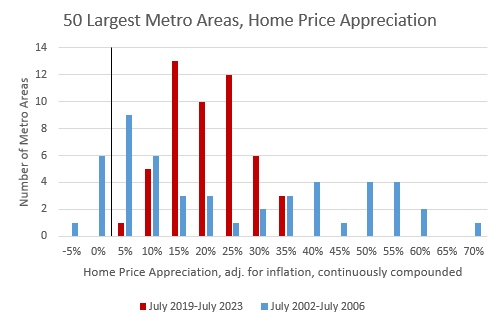

Here is a chart comparing home price appreciation over 4 years for the 50 largest metropolitan areas. The blue bars end in July 2006 and the red bars end in July 2023. The way to read this is, for instance, from 2002 to 2006 there were 6 metro areas where the median home price increased by between 5% and 10% (adjusted for inflation) and from 2019 to 2023 there were 5 metro areas where prices increased between 5% and 10%.

It is clear, with a cursory glance, that this “housing bubble” is quite different from the previous one. The boom that ended in 2008 was all about outliers, to an amazing degree.

The national median home price appreciation is pretty similar in the two periods, but most of the 50 largest metro areas in the 2002-2006 period fell outside the entire range of the 2019-2023 period! Both above and below!

The 2002-2006 period was about regional housing supply crises, which triggered a migration event that pushed a handful of other cities into unsustainable price trends. The rest of the country had a housing market that was, basically, normal. The modal city saw real price appreciation between 0% and 5%.

It’s sort of amazing that there wasn’t an uproar of opposition to the bubble-popping policy choices of the time from all of those normal cities! Some of the most adamant bears on the Federal Reserve were from the Kansas City and Dallas districts, in which nothing had happened!

Anyway, this brings up an interesting conundrum. There are many more cities today where home price appreciation has been high enough above inflation that a naïve analysis would lead to an expectation of a sizable reversal. On the other hand, all of the extreme valuation changes that motivated the 2008 moral panic and made collapse so popular were well above the range of price appreciation we have seen recently.

So, are we due for a collapse or not?

More below the paywall.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.