September Residential Construction

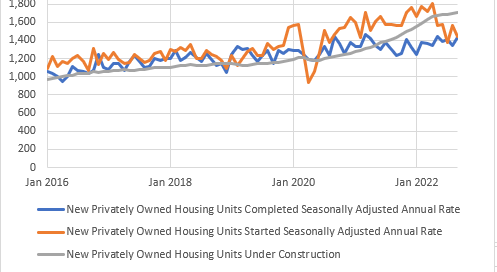

Last week, monthly construction numbers were updated. I would say that, all in all, we are still flirting on the edge between Category 1 (new construction rising faster than supply capacity can accommodate) and Category 2 (new construction rising slower than supply capacity, but still an excessive backlog).

For total units, we are still in Category 1. Total units under construction is still rising. Units completed continues to be basically flat.

The strength is entirely from multi-unit construction. Starts remain strong while completions remain flat. The backlog in multi-unit is actually growing. Multi-unit is firmly in Category 1!

Single family construction is now firmly in Category 2. Starts are below completions, so the backlog is just starting to shrink. At the current rate of construction capacity, a normal market would have about 600,000 units under construction, so the backlog is still bloated by about 200,000 units.

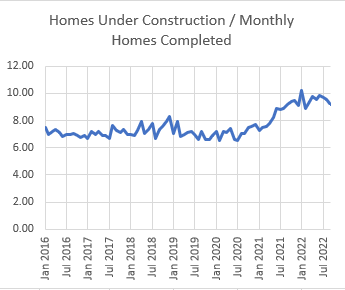

I have been watching the ratio of the number of homes under construction/monthly homes completed (which is for single family construction), which is basically an estimate of average months under construction. It had been approximately 7 months for decades, never systematically deviating from that level. Then, the Covid-era supply-chain issues drove it up to 10 months. In September, it dropped down to 9.15 months. It is still well above a normal construction schedule, though declining.

I suppose the obvious intuition here is that high interest rates are probably creating some funding frictions in the single-family space, slowing down sales and starts, even while the backlog of sold homes is still jammed up. But, the activity in multi-unit suggests that there is still optimism among developers. A surprising amount of optimism, really, since the backlog of projects already under construction just keeps deviating from the norm, which will surely push up costs if it doesn’t improve.

As single-family sales decline, I suspect that there will be less inflationary pressures on construction inputs, even if completions continue at the existing pace. Builders will still be trying to finish their inventory, but they will be less able to bid up costs to complete sales as rising interest rates lead to more cancellations and reduce the recent excessively high margins. I wonder if this actually improves market conditions for multi-unit developers, who were probably less interested in bidding up the price of inputs than the single-family builders were. If that’s the case, it suggests that with more stable costs, build-for-rent buyers might present a floor for single-family builders if owner-occupier demand continues to decline below supply capacity.

Anyway, in a market not constrained by the supply chain, we could be building at least 2 million units a year. That would be associated with units under construction higher than they are today. The normalization we should be aiming for is to have more units under construction, but to be completing a lot more of them each month, so that single-family home construction is back to 7 months again. If supply chain problems can get solved, so that some normal rate of growth can be attained, we should hope and aim for a marketplace where sales and starts rise along with it. If supply chain issues can be resolved, rising demand shouldn’t be inflationary.