Craig J. Richardson & Zachary D. Blizard have an article just out in “Public Choice” that shines light on the credit shock that I incorporate in the Tracker.

New America published a report on their work back in November 2021.

They looked particularly at a poor section of Winston-Salem, North Carolina, and they found effects of mortgage suppression similar to what I have found in my more broad nationwide analysis. I have inferred these effects from the coincidence of income-sensitive price trends and credit score trends in mortgage origination. They go into more detail about the effects of Dodd-Drank on small dollar mortgages, in practice, and the changes that have occurred as a result in the neighborhoods they studied.

Lots of important nuggets.

They consider three issues. (All inset quotes are from the New America report.)

1) the unavailability of financing for small dollar loans

A 2019 Urban Institute analysis finds that nationwide, denial rates for conventional small dollar loans (less than $100,000) are nearly four times as high as denial rates for conventional large loans ($100,000 or more)… Applicants of small dollar loans have similar credit profiles to applicants of larger loans, and that gaps in the denial rates persist even after accounting for applicants’ credit scores. So what accounts for lower small dollar originations compared to large loans in the United States? Existing research ties the unavailability of small dollar loans to regulatory and structural changes in the real estate industry in the wake of the Great Recession… These regulations, designed to protect borrowers from this kind of predatory lending, also increased the fixed costs and the per-loan costs of extending a mortgage.

These regulations increased the fixed costs of originating a loan…and capped the fees and points that lenders can charge.

So, now, small loans are frequently unsustainable for banks. High fees have been replaced with denials.

The New York Fed has tracked how mortgages originated to low credit score borrowers has collapsed. The Census Bureau has tracked out sales of new homes at low price-points has collapsed. In Figure 1, the authors show how small dollar mortgages have collapsed in Winston-Salem.

2) the catch-22 of mortgage standards

We’ve created the mortgage equivalent of back alley abortions.

Those locked out of the market are left with few choices; they either continue to rent, or enter into riskier alternatives, including rent-to-own agreements and contract-for-deed sales. These predatory housing arrangements, more prevalent in Black and Latinx communities, require buyers to pay off the price of the home without a proper title or rights to the home until the end of the term.

Also, FHA standards about property conditions can prevent low-end buyers from purchasing a fixer-upper. The report mentions that this, ironically, nudges low tier buyers to more expensive units. Compared to the fixer-upper, the mortgage costs more while the maintenance costs less. That makes the rise in debt to income (DTI) ratio induced by these rules look even higher. And:

The Department of Justice (DOJ) during the Obama administration leveraged the False Claims Act to penalize FHA lenders for errors in their underwriting of FHA-insured loans, often bringing multi-million dollar lawsuits against FHA lenders. The lack of consistency and predictability in DOJ enforcement caused many lenders to pull back from offering FHA loans altogether.

3) competition with all-cash buyers.

Three quarters of homes costing more than $100,000 were purchased with the help of a mortgage loan in 2019, whereas only 23 percent of homes below $100,000 were purchased with a mortgage loan. Instead, investors and all cash buyers have largely purchased small dollar homes to flip and sell for a profit or for rental income.

Denial rates on small dollar mortgage applications are especially high in East Winston.

Effects on Prices

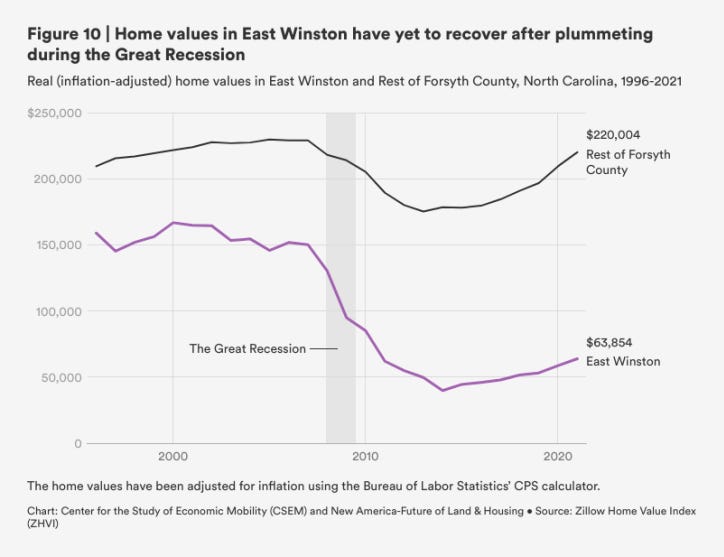

Figure 2 will look familiar to EHT readers. In Winston-Salem, from the end of 2007 to 2014 home prices declined much more steeply in poor East Winston than in the rest of Forsyth County.

Figure 3 shows the proportion of homes purchased with a mortgage vs. cash in all of Forsyth County over time. Most purchases were funded by mortgages before the financial crisis and after.

Figure 4 shows the same proportion for small dollar homes in Forsyth County - many of which are in East Winston.

There are three notable issues here. First, the severe drop in mortgaged purchases for small dollar homes coincides with the sharp drop in prices. Second, before the financial crisis, small dollar homes were funded with mortgages almost as often as other purchases were. Third, as with so many of the tragic housing policy stories over this time period, the scale of the market suppression is huge.

This work does a great job of tying the macro-level trends that I write about here to real activity on the ground, and practical obstacles faced by lenders and buyers.

They estimate that regulations associated with Dodd-Frank lending are related to a collapse in home values in East Winston of approximately 40%. That seems to be in the ballpark of the Credit Shock estimate I use of about 22% per point of log income.

Causation and the Inevitability of Collapse

I think it is worth pondering a more fundamental reconsideration of the housing boom and bust.

First, I think they may actually be underestimating the effect of mortgage regulations on East Winston home values. In the tracker, I use the median credit score on new mortgages reported by the New York Fed as the rough proxy for the Credit Factor. The change in credit scores on approved mortgages was relatively flat from 1999 through 2007 and the shift to higher scores had largely happened by the end of 2009. Dodd Frank wasn’t passed until mid-2010.

I think the underwriters at the FHA and Fannie & Freddie were generally in control of the market by 2008. It is possible that Dodd-Frank added some constraints and codified some existing constraints, but that most of the broad changes in underwriting standards were already in practice.

Figure 5 from their appendix estimates foreclosure rates from 2008 to 2020 in East Winston and in the rest of Forsyth County. The peak foreclosure years were 2009 and 2010, and the vast majority of excess foreclosures happened after 2008.

Here are two quotes from the report.

What does East Winston’s foreclosure crisis have to do with small dollar homes? The precipitous decline in home values and lack of rebound in East Winston is likely the result of the high volume of predatory loans pre-crisis resulting in a high number of foreclosures. At the same time, changes in banking regulations since 2009 may have prohibited the kind of rebound seen in other parts of Forsyth County.

While it is critical that communities are protected from the kind of predatory lending that led to the immediate collapse in home values in 2008, regulations keeping families from obtaining reasonable mortgage loans may be going too far in the other direction.

What if we didn’t arrive at this analysis with the pre-supposition that predatory lending before 2008 must trigger a collapse in home values? What if all we had was the information above? Suddenly, by 2008 mortgages aren’t widely available in East Winston, home values collapse, and foreclosures spike.

Would we feel like we needed any further explanation of what happened? Would we keep looking for causes until we happened upon loose underwriting from 2004 to 2006 (which, by the way, was not associated with a spike in low dollar mortgage lending, home values, or construction activity)? In fact, considering the lack of important correlations with those other variables, would it even be on our radar screen?

May I suggest that the Bayesian updating on this topic has been poisoned with some hefty priors that never deserved the weights they were given, and they are still infecting our inferences about new information.

It could very well be that when we shat all over the East Winstons across America, there were no predatory bankers that made us do it. The data above could very well be the whole story. You don’t have to wish away the existence of the predatory lenders, etc. to wonder (1) if they really had much impact on markets like East Winston, and certainly (2) if they necessitated any of the restrictions that are correlated with the 40% drop (or more) in home prices in East Winston and the loss of aspirational working class homeownership in aging and affordable neighborhoods across the country.

Sabiha Zainulbhai, Zachary D. Blizard, Craig J. Richardson, & Yuliya Panfil have some useful input on these questions. As hard as the answers may be to admit, it’s well past time to ask them.

The authors use data at the Census tract level. My data is at the ZIP code level. The scale of socio-economic segregation tends to scale with the size of a city. Winston-Salem only has about 250,000 residents. My data doesn’t show a lot of systematic patterns in Winston-Salem, and I suspect that in a city that size, ZIP codes aren’t distinctive enough. But smaller areas, like Census tracts are, and that East Winston happens to be a defined enough small enclave in the county to show the same patterns that I rely on ZIP codes for.

Sorry for OT, but you will like:

https://blog.rangvid.com/2023/08/06/us-core-inflation-2-percent-or-5-percent/

"If inflation in the US were measured as in the euro area, it would be only 2%."

What purpose does the FHA serve if not to get lower income Americans into home ownership? I remember the experience of getting our first mortgage in 2010 and how the FHA route was considerably more complicated and expensive than the conventional private lender approach. Housing construction from 1945 to 1980ish depended in large part on the FHA and other government entities. It was part of the strategic initiative of having a dispersed suburban population that could weather a nuclear attack.