Hot on the heals of the Erdmann Housing Tracker January update, the Wall Street Journal published a story about former Silicon Valley big wigs backtracking. The story focuses on VCs and entrepreneurs that moved from San Francisco to Miami during the Covid event, and now some of them are moving back.

Does the data bear this out?

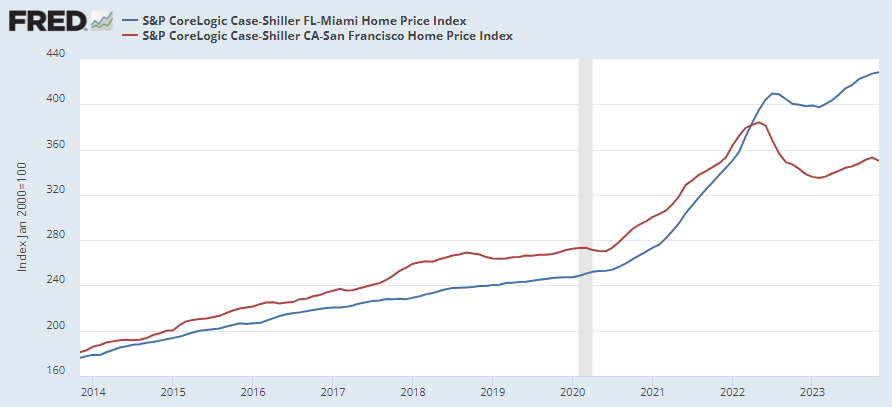

Figure 1 shows the Case-Shiller home price index for each city. Miami is still hitting new highs while San Francisco has recently been declining.

How about housing construction? Both cities have low housing production. Miami was able to accommodate a surge of building before the Great Recession. Otherwise, both metro areas have relatively low maximum construction rates which they tend to hit early and remain at throughout the expansion. Miami’s is a bit higher than San Francisco’s. And, Miami construction has recently continued to be a bit higher than San Francisco’s. So, the decline in San Francisco home prices is not because of an increase of construction.

I had previously expressed hope that a downward trend in San Francisco home prices may have been a sign of expectations that YIMBY wins would produce more housing. That hope has moderated quite a bit.

In fact, in Figure 2, it looks like San Francisco construction has been waning. This is especially odd because when new home construction rises above about 3,000 units per quarter, construction plateaus there, regardless of how much demand there is. The supply curve turns vertical at about 3,000 units per quarter.

That means that it should take a major catastrophe, like 2008, to pull construction activity below that plateau. A little bit of outmigration shouldn’t be enough of a catastrophe to do that. Land and homes are still very expensive there. There is a lot of margin for markets to find a way to pull together a few thousand units.

Maybe, since cash returns (cap rates, etc.) on real estate in housing deprived cities are low, rising interest rates have had more of an effect on new construction there than they have in other places. Maybe San Francisco developers have been holding off while new state laws were passed that might soon increase developer design options.

Those issues might bear watching. But, I think we can say with some confidence that if there is now a reversal of Covid population flows back to San Francisco, it is not showing up in the housing data - either in prices or construction activity.

A few more details for subscribers below the paywall.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.