October 2024 Inflation and Housing

Inflation is now a full 27 months into a clear and sharp return to a 2% trend path, though you wouldn’t know it from the reporting on it. Figure 1 shows several CPI indexes, with and without shelter included. The indexes without shelter are the appropriate indexes to use for monetary policy. (Background piece explaining why.)

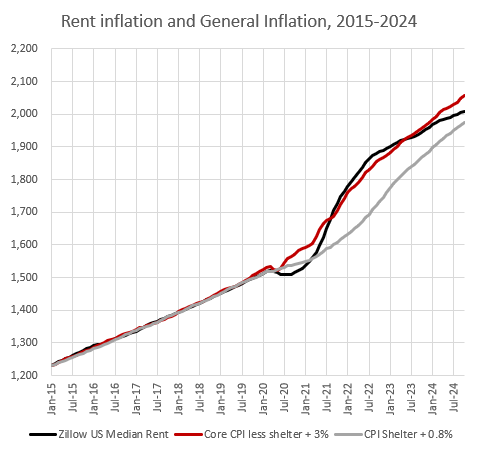

Under current conditions, where there is a transitory spike in inflation, the CPI methodology has a known lag. Figure 2 shows the Zillow estimate for typical US rent (ZORI). I compare it here to CPI Shelter (+.08% to account for compositional changes over time in the ZORI measure) and to CPI excluding shelter (+.08% for the compositional changes and +2.2% to account for the long-term supply-side price inflation in rents).

You can see that the lags in the CPI shelter component are almost all worked out, finally. And, it looks like excess rent inflation might finally be subsiding. (Largely because Jerome Powell didn’t let a recessionary construction contraction happen.)

You can see that more clearly in Figure 3. This is year-over-year inflation. Taking out the compositional change, Zillow rent has been running about 2.5% for a couple years now. CPI inflation excluding shelter has been running right at 2% for more than 2 years.

This is fantastic! JPow! is basically targeting my monetary policy. Ignore rent and run everything else at 2%! And, since he’s doing that, and since home prices have finally recovered enough to trigger build-to-rent construction, rent inflation might eventually decline from here.

JPow! always hits home runs.

Finally, the chart showing cumulative rent inflation vs. general inflation. I think we can put a check on it. Excess rent inflation has been conquered. Now, we just need to spend a decade or two with a building boom to reverse it.

Say a prayer tonight for JPow!’s good health.

Some, however, remain worried!

https://marcusnunes.substack.com/p/brief-notes-on-todays-cpi-release

https://www.bisnow.com/national/news/capital-markets/office-loans-are-the-feds-top-concern-in-stress-test-report-126841?rt=100280&utm_source=outbound_pub_6&utm_campaign=outbound_issue_81722&utm_content=outbound_link_2&utm_medium=email

This is OT a little, but office loans are looking uglier than the Yankees World Series play, and getting worse.

But..no recriminations, no howling that banks were too easy on borrowers, that in the future credit quality and down-payments have to be raised, etc.

Some of those correctives may be taken, and fine and dandy...but there is no moralizing, and beating up in general of commercial property borrowers.

Commercial property was also whacked hard back in 2008. But only the residential side got the headlines.