Notes on D.R. Horton 2nd Quarter Earnings Call

In yesterday’s post, I wrote, “D.R. Horton reports earnings tomorrow morning. I expect them to report continued tepid strength in sales activity and completion times. The market will slowly come to accept that the builders aren’t doomed to any contraction.” D.R. Horton answered that with an exclamation point. Both earnings and forward guidance were well above analyst estimates.

The nice thing about mostly ignoring interest rates regarding net housing market activity and price trends is that most of the market cannot be talked out of focusing on it. It makes too much conceptual sense, and there is too much corroborating evidence about tertiary market activity where interest rates are important. So, you will have willing counterparties until the cows come home who will just keep being surprised, time and again, while reacting to those surprises with “Well, in spite of high (or low) interest rates, this and that and the other thing happened.”

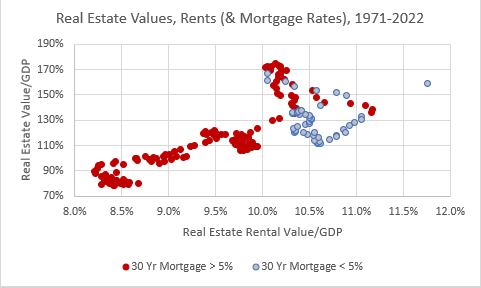

I’m getting sidetracked here, but here’s a visual I happened upon that I liked, on this topic. I wish Excel allowed me to use a gradient on the colors. But, here is a scatterplot of aggregate real estate values and aggregate rental values over time. One possibility in housing is that prices could be higher because of both higher rents and lower mortgage rates. It doesn’t have to be either-or. But, here, I have color coded the plot to show the period with the lowest rates. Even after accounting for rents, mortgage rates give the wrong sign.

I don’t disagree with the standard financial thinking on this. Surely, if we control for everything, mortgage rates must have some negative correlation with prices. During that period with low rates in Figure 1, I would even argue that tight lending standards are the primary omitted variable, and just controlling for that one variable might produce some negative correlation between rates and prices.

But in a world full of blind men, the one-eyed man leads. And in a world obsessed with forecasting a strong negative mortgage rate effect, the man who ignores rates earns alpha.

In housing, this is especially powerful because it is paired with another conceptual misunderstanding that the Fed encourages constantly - that interest rates are controlled by the Fed and low interest rates are a sign of stimulus because they mean that firms are borrowing more to invest.

If you’re long housing, given two scenarios two years into the future: (1) mortgage rates are still over 5%, or (2) mortgage rates are back down to 3%, you really probably should be hoping for #1, to the extent that you care about interest rates.

The very significant spike in interest rates last year did have unusually measurable effects on the homebuilders, largely because it created transactional frictions for buyers who hadn’t been able to lock in rates when they ordered unfinished homes. That caused cancellations to spike.

As I wrote back in January:

It is possible that cancellations will remain high, but we shouldn’t conflate the past cancellations with future cancellations. The rate-induced cancellation will subside because the homes being completed this quarter, and especially next quarter and beyond, were sold after rates had risen and so the shock to buyer financing will have passed. It is possible that a deepening economic contraction could lead to continued high cancellations, but that will be largely a separate issue, related more to price expectations, potential unemployment, shifts in migration, etc.

The rate-shock motivated cancellations have passed. From D.R. Horton: “Our cancellation rate for the quarter was 18%, up from 16% in the prior year quarter, but down 27% sequentially.”

We’re back to normal. All the homes being finished now were sold after rates spiked.

More on D.R. Horton’s comments below the fold:

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.