Last week there was a wave of breathless coverage about changes in fees at Fannie and Freddie.

One nice thing about the housing issue is that it is not partisan, or at least the partisan aspects don’t map to the normal left-right divide. So, over time I have become less tempted to be overtly political. There’s plenty of dumb stuff on the left and on the right, but also plenty of people willing to be a part of progress from both sides. Even a curmudgeon like me can mostly just focus on getting the facts right and building the case for the progress plurality. Or at least I try.

But, this was so ridiculous, and so deeply rooted in partisan inanity, that I think it deserves a post.

As far as I can tell, it started at The Washington Times. There are several claims in their article. I’m going to generally limit myself to the issue of fees. The headline is “Biden to hike payments for good-credit homebuyers to subsidize high-risk mortgages”. The first line is “Homebuyers with good credit scores will soon encounter a costly surprise: a new federal rule forcing them to pay higher mortgage rates and fees to subsidize people with riskier credit ratings who are also in the market to buy houses.”

Maybe there is some evidence deep in the spreadsheets of the FHFA that these new fees will create a loss that needs to be cross-subsidized by more qualified borrowers. I don’t have hard evidence to the contrary, but it seems unlikely.

Before I move on, Figure 1 is a chart highlighting the changes in fees. There are upfront fees on new mortgages meant to cover risks, so they are higher for borrowers with lower credit scores or lower down payments (“LTV” in the charts is “Loan to Value”. LTV = 100 minus down payment.) The fees in the chart don’t include the array of additional fees that apply to some loans for being a cash-out refi, an investment property, adjustable rate, etc. This is for fixed rate loans in a regular market, for purchase, including mortgage insurance fees, where applicable. The x-axis is the LTV and the 4 lines are for 4 different credit scores (620, 640, 720, and 780). Data are from here and here.

The way to read the charts is, for instance: what is the new fee for 720 credit score with a 20% down payment? That’s the dark dashed line in the right panel at an LTV of 80. The fee is 1.25%. The new fee for a credit score of 640 with 20% down is 2.25%.

These fee schedules are what the hubbub is about. Fannie and Freddie are changing from the left one to the right one.

From the Washington Times, the topic reached Fox. The fox online story mostly cited the Washington Times story. There are a lot of vaguely true references to the change in fees, worded in a way that encouraged a certain reaction. Here’s a screenshot from Fox television, where the story really gets its wings.

I’m pretty sure what they’ve done here is cherry pick the low credit score that had the largest fee decrease. Then, they reported the total fee of a higher credit score. So, a low down payment 620 score has a fee that went from about 6.75% to 5% (when mortgage insurance is included). And, also, the fee for a 740 score went from 0.25% to 1%. (plus a 0.25% mortgage insurance fee). Why didn’t they just say that fees for 740 scores went up 0.75%? It would still get their partisan point across. It would still be weird, because it would be describing mortgages with two different down payments. And it would hide the fact that the 620 score still has a fee that is more than 3% higher than the 740 score. But, at least it wouldn’t be mixing levels with changes.

I don’t really know what motivations and processes led to this graphic, but I think we can safely say that they don’t include “competently conveying objective and useful information”. Just to make sure the point gets across, the label adds “No credit for good credit” which takes it really into “untruths” territory. Many viewers and commenters have taken it to mean that having a high credit score will make you worse off now.

National Review put out an article, citing the Washington Times and Fox, and by now the reporter at National Review was really feeling his oats. The headline: “Democrats’ Atrocious Attack on Personal Responsibility”

The subheading: “It’s difficult to understate the perverse incentives that penalizing homebuyers with good credit will create.”

… Wait. Either the sub-heading writer has a devilish sense of humor, or they inadvertently wrote something true. I think they mean “overstate”.

The NR article includes these zingers:

And Americans who did everything right are going to suffer, perversely enough, because they did everything right.

It’s difficult to understate the perverse incentives this act of bribery will encourage. (Again, they must have meant to say “overstate”.)

You’ve spent your adult life borrowing responsibly and paying your bills on time… For all your diligence and hard work, the Biden administration will now punish you only so that consumers who were not similarly conscientious can have access to better mortgage rates and lower down payments. Knowing that, why on earth would you devote yourself to an unrewarding enterprise like thrift when someone, somewhere will foot your bill regardless?

All of this over the fee schedule in the right panel of Figure 1.

I haven’t been able to find any comparable schedules from before 2008. If any readers have a link to something, please share it. My guess is that these fees have been too steeply applied since then, though that is a somewhat unanswerable question, since nobody can know what the future correlation between foreclosure costs and these characteristics will be.

That’s what so ridiculous about these reports. They’re reacting to what is, essentially, an actuarial decision.

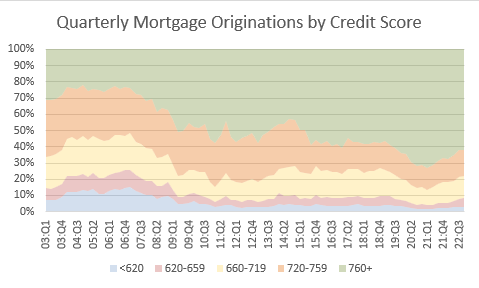

One reason to think these fees have been too high is that mortgage originations to borrowers with credit scores less than 760 have been extremely low since the Great Recession. Figure 3 and Figure 4 give a sense of that scale. (The median credit score tends to bounce around 710 or so.) I suspect the main issues preventing low-credit score borrowing are a complicated web of items in the underwriting process that would create denials, even at the new lower fee levels. So, I doubt that lower fees will help much. I will be very happy to be proven wrong, if that is not the case.

Even if you think the new fee structure really is a subsidy, rest assured, it is a subsidy few will get.

But, what is especially galling to me about these politicized takes is that over-regulating mortgage access essentially stole $5 trillion in net worth from America’s working class neighborhoods. And, now, after a decade has basically baked that theft into the American economic landscape, these yahoos come sweeping in with their hot takes about how the “Biden administration will now punish you only so that consumers who were not similarly conscientious” can take your hard earned money, because they now have to pay a fee that’s only twice as high as your fee.

Keep in mind, as terrible as urban land use regulations have been, the scale of the damage to the US housing stock from the post-Great Recession mortgage suppression that shows up so clearly in Figure 4 has probably been much greater. Figure 5 is the real per capita housing expenditures chart I have shared a time or two before.

The post-Great Recession dip in real consumption of housing shown in the chart has coincided with the highest-ever per capita spending on housing. Spending more. Getting less. And that change in consumption and costs has been regressive. The poorest families are getting the least and paying the most of everyone. But, yeah. I’m sure that new 4% fee is the first step on our sprint to a dictatorship of the proletariat.

PS: See this postscript.

I am a retired mortgage loan officer. My recollection is that loan-level price adjustments were first introduced in 2008. In my opinion, they have no relation to actual loan losses and should be abolished.

I liked your article, thank you. I’m a loan officer in Milwaukee and I saw many in my network share/post the Fox News screenshot. Very misleading.

In practice, my response has been to help clients get into the “affordable” programs Fannie and Freddie offer, there’s an income based program (not even for first time homebuyer) and also a first time homebuyer program. Based on either <80% area median income and <100% respectively.

Both of those programs have a full waiver of ALL LLPA adjustments. 660 score gets the “same rate as grandma” with a 40% DP and 780 score. I call it “grandma’s rate” with my clients.

It’s not necessarily fair, but they appreciate it. When we as lenders are forced to use a GSE under conservatorship, you don’t really get an option besides to play with the rules we are given.