In this post I will use data from Hovnanian (HOV) to think through sales and production trends of homebuilders. All of the charts here are numbers from Hovnanian quarterly filings.

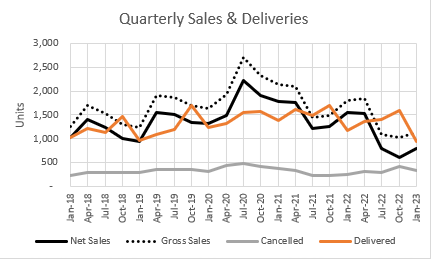

First, here is net sales (black), cancellations (gray), gross sales (sales without deducting cancellations - dashed), and deliveries (homes that have been sold and finished - orange)

As an aside, I hadn’t realized how strong cancellations had been during the Covid boom. The convention is to state cancellations as a percentage of sales, and since sales were booming in the summer of 2020, cancellations as a percentage were small, and nobody was too worried about them anyway.

So, the high cancellation rates recently associated with the spike in interest rates haven’t been particularly high in absolute terms. They were amplified in percentage terms because sales had declined so much. Total cancellations were higher in the summer of 2020 than they were in late 2022.

A more nuanced view of housing can really open up a significant space from conventional expectations. Conventionally, some aspects of the current market look like a classic bear market setup. Sales collapsing. Cancellations spiking. And, presumably, high interest rates creating a deep drop in sales and market prices.

But, the drop in sales wasn’t a traditional market decline. There isn’t a deepening pile of unsellable inventory. Reported cancellation percentages were inflated by these factors. And our little secret is that interest rates are a poor input to use for forecasting sales and home prices.

Builders are already reporting a decline in cancellations. You can see it already in Hovnanian’s 2023 first quarter numbers, and reports are that they continue to decline. This is a signal that the conventional bearish take is wrong.

Looking at deliveries, Hovnanian looks like it’s back to the level of units it was producing in 2018 and 2019. That’s not great. But, it still appears to be mostly driven by Covid-related supply chain capacities. In fact, for all the big sales numbers, Hovnanian has never delivered more homes than it did in the 4th quarter of 2019. We are still in a “capacity condition” far from a “surplus condition”. We haven’t even gotten to a “normal condition”, and it takes a lot of concerted effort to break out of a “normal condition”. It doesn’t happen quickly or by accident.

More below the fold:

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.