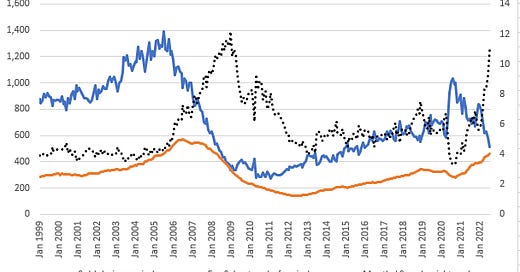

The July report on new home sales has triggered a lot of calls that we’re in a housing recession. You can understand why. Figure 1 shows the trends in homes sold, homes for sale, and months’ supply of homes for sale. Looks like we suddenly find ourselves in late 2008 territory. And I don’t have to remind you what late 2008 territory was like.

This is a weird cycle, though, because inflation has been coming from both supply chain problems and from inflationary conditions. We are hot and cold and cold and hot all at the same time. It’s hard to know which reversals are good and which are bad.

As a start, it might be helpful to think of the status of the housing market today through the following categories:

Demand outstripping capacity. Sales high, homes under construction increasing.

Demand normalizing. Sales declining, homes under construction high but decreasing.

Demand overcorrecting. Sales declining, homes under construction declining.

Demand excessively overcorrection. Sales bottoming, homes under construction declining, prices declining.

A quick review of 2005-2008: Category 1 was only localized then. A few major cities are perennially at their chosen capacity for housing production, so that the rest of the country had to make up the difference, so much so that some of the rest of the country hit its capacity for housing production.

We could have kept coasting along at 1 million + annual home sales. That would have been good. Today rents would probably still be high by mid-20th century norms, but maybe lower than they had been in 2005. Nationally we were never in Category 1, so in late 2005, we went from a normal market to Category 3.

Because of that, for a brief period homes under construction continued to increase because builders were trying to meet expected demand that suddenly crashed. But, units for sale peaked in June 2006 when months’ of supply was at 6.2. We were in Category 3 for about a year after that. In June 2007, months’ of supply was at 7.8 even though the total inventory of homes for sale was slowly shrinking. Then, we entered Category 4, and stayed there for years. Months’ of supply topped out at 12.2 in January 2009! That was purely the result of engineering a Category 4 collapse. The number of homes for sale in 2009 was pretty normal. Sales had cratered.

Recently, builders have been starting new homes reluctantly, because they are already hitting the capacity of supply chains. That is because today, nationally, we have been in Category 1.

This makes analysis difficult. There’s a big difference whether there are more homes under construction because there aren’t any buyers for finished homes vs. more homes under construction because the builders can’t find enough windows and appliances to finish them up.

One way to look at this is “Homes under construction / Monthly Homes Completed”. This is basically an estimate of the amount of time it takes to build a home. In Figure 2, I am showing this all the way back to 1970 to show what an anomaly the current situation is. Homes have taken 6-7 months to construct for decades, until 2021. It currently stands at 9.7 months. This is what “Category 1” looks like, and we’ve never been in it before, at the national level.

.

It is important to keep this in mind when you see fear-mongering posts about how we have an oversupply of housing coming because we have a large number of homes under construction. In 2005 there were a lot of homes under construction, because builders were planning for a continuation of high demand, and they had the capacity to meet that demand. So when homes under construction increased, it was associated with an increase in the flow rate of completions. That isn’t what’s happening today. Homes under construction reflects demand higher than supply capacity today, and so these are just advance sales. Whereas the higher throughput of homes under construction in 2005 made builders more vulnerable to a sales collapse, today, the extra homes under construction are insurance against a sales collapse.

Also, I would like to note that this is not the behavior of an oligopoly. Oligopolies don’t get their supply chains tied up and maxed out, increasing inventories and the risk of cost variances, so please take all the papers and articles that claim lower supply and higher prices are the result of industry consolidation and market power, and put them in a drawer for now. It was an interesting idea, and it has failed to replicate, as it were.

You can get an idea of where things are at from this week’s monthly home sales report.

The homes for sale under construction and homes for sale that haven’t been started look similar to late 2006. But, in late 2006, the steep decline in sales was from a normal starting point, and those were homes the builders needed to find buyers for. Today, the extra homes are more likely to be tied up in supply chain delays. And, here, the number of finished homes for sale is a good clue. It was very high and peaking by late 2006, and today it is very low. In 2007, that measure had risen substantially and peaked before home prices collapsed or recession started.

The Census Bureau publishes a “Median Number of Months for Sale” figure, which you don’t see referenced nearly as often as their “Months’ Supply” figure is. This figure is the median number of months that a completed home for sale has been completed and unsold. It reached a record low this month, shown in Figure 4. Again, note, this measure didn’t increase until well after sales had started to fall in 2006, and yet today, it is going in the opposite direction.

In summary:

In 2006, we were in a regular market that, nationally, had not been supply constrained, but local supply constraints had initiated a lot of distortions and economic difficulties. When sales started collapsing, that was an immediate transfer into a Category 3 context. We were in that context for quite a while, and by late 2007 when prices started collapsing and recession hit, we were finally in a Category 4 context. We had to endure months of poorly targeted public policy for that to happen.

Today, we might have just transitioned from Category 1 to Category 2 in the last couple of months. For paid subscribers, below the pay wall, I have a couple of bonus charts that I don’t think you’ll see anywhere else, that help to estimate the scale of how far we are from Category 3.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.