July 2023 New Residential Home Sales & Builder Updates

I am having a hard time divining any clear narrative patterns from the data right now. The general patterns continue - a return to moderate sales growth, stabilizing prices, low finished inventory, high but stabilizing inventory under construction, etc. You can see much of that in Figure 1.

Figure 2 shows new home sales by stage of construction. The last 2 months had shown a surge in sales of unstarted homes, but that has been completely revised away. As far as I can tell, total sales weren’t revised much, but the sold units were moved to other categories, so that was a bit of a false signal of sales strength. Probably, that just moves us from a “potential overheating” trend to simply a continuation of moderate growth.

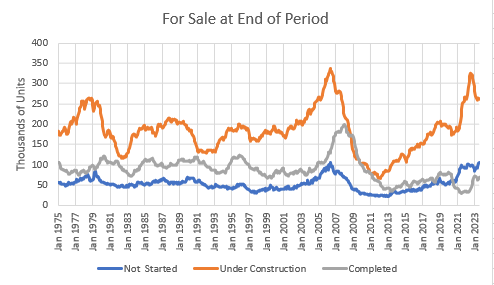

The July construction report last week showed a continuation of normalizing construction timelines - fewer delays in getting homes finished. All else equal, I would expect that to reduce units under construction. But, as shown in Figure 3, homes under construction that are for sale has levelled off at just over 260 thousand units for several months.

The residential construction report hasn’t shown a clear increase in completions, which implies that the normalization of construction times has come more from demand declining to capacity rather than from a rise in capacity. But, in this report sales are rising. So, maybe units under production has forces pushing it in both directions, and completions will soon be rising in line with rising sales.

In Figure 3, units under construction is similar to the early 2005 level. Unstarted units for sale is a bit above 2005 and finished units are a bit below. But, looking back at Figure 1, sales has a long way to go to get back to 2005. It seems like the high inventory for sale must be still related to construction delays.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.