Hovnanian and Toll Brothers finish up this quarter’s reports, both with fiscal year earnings, as of October 31. Both continued the current homebuilder tradition of “surprising” to the upside (though Hovnanian gets so little analyst attention, I suppose it’s hard to claim something was a surprise if nobody was watching).

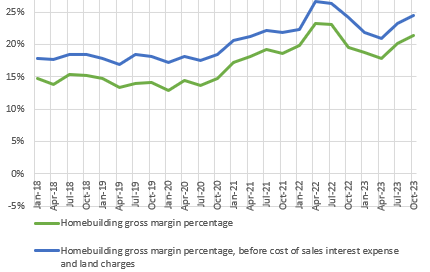

You can see the rhetoric shifting with both, away from “excellent results in spite of rising interest rates” to “excellent results coinciding with peaking rates”. I’m not sure it matters much from a supply perspective, since housing is still supply constrained, so the builders are starting homes based on the pace they can be completed more than on the pace they might speculatively be sold. The price of finished homes is set to that pace, which remains somewhat above the price associated with cyclically normalized margins.

Just some brief notes, mostly on Hovnanian, below. For subscribers.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.