Little victories are starting to show up here and there.

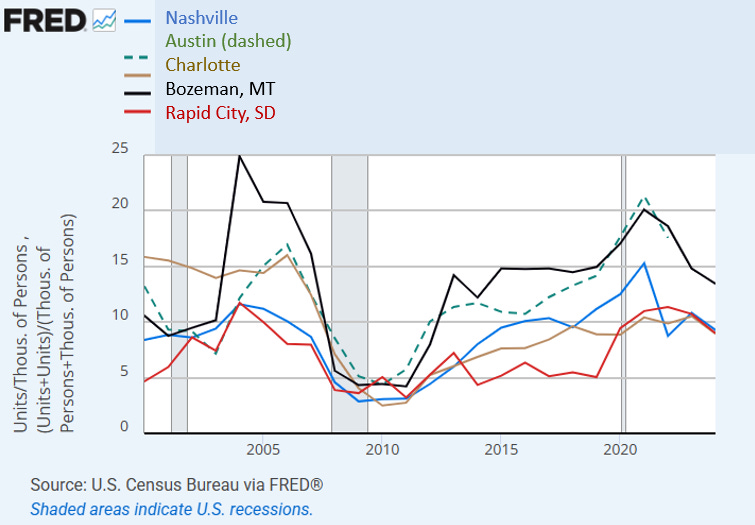

Of course, Austin is the superstar. I have pointed out that Nashville and Charlotte are also doing relatively well. I also noticed a couple smaller local victories. (Figure 1)

Bozeman, Montana has been on a building tear. It’s total permitting rate is as good as Austin’s, but it is mostly single-family, which may be ok for that jurisdiction.

Rapid City has also had a bit of a building boom - more in line with Nashville and Charlotte than with Austin. But, Rapid City seems to be really supporting multi-family construction.

Austin does really seem to have started to reverse price inflation in the way that new supply does. There was some cyclical reversal that was bound to take place, but they have gone beyond that in a way that points to supply relief. Nashville and Bozeman look like they have slightly better than average price trends.

Similar patterns look to be showing up in rents. Rent trends look amazing in Austin and somewhat better than average in Nashville and Bozeman. Charlotte and Rapid City still look relatively average.

We are really 17 years into a tricky time, empirically. Before 2008, housing costs could be easily attributed to local supply constraints across cities (with a brief head fake in the Contagion cities that were overwhelmed by newcomers escaping the housing deficits of the Closed Access cities). After 2008, rent and price inflation were elevated across the country. And housing construction collapsed across the country (except for, ironically, in the cities that had previously had the worst local supply constraints). For the naive, the misdirected, and the bad faith, that could be misconstrued as evidence against the importance of supply, because housing inflation stopped being correlated with past estimates of local supply constraints.

Then, Covid hit, and we are still suffering under tight capacity constraints of post-Covid supply chain disruptions (and federal non-residential construction stimulus that has claimed some resources). Rent inflation finally added up to enough to induce new investment into rental homes, which can finally overcome the headwinds of the mortgage crackdown. But, those units can’t be completed as quickly as developers would like. So, resources are still being distributed in a way that is not well correlated with local supply conditions.

This will change. Cities that allow more multi-family construction and that allow single-family new home construction will see the benefits of that as new home construction is able to grow.

This is just the beginning.

A few more anecdotes about Rapid City:

-Recent growth has largely been in response to a slow moving expansion of Ellsworth Air Force Base. The multifamily boomlet has been a function of demand from service members who are on short rotations.

-I observed a fair number of established trailer parks in and around Rapid City. Although the snooty architect in me regards that type of dwelling with some skepticism, it's a critical component of a broad based housing stock. It also ties into the seasonal features of the area---which includes huge R.V. encampments in the Black Hills and spillover effects from the annual Sturgis biker rally.