For subscribers, I am going to go into a little more depth about home sales and new home inventory, and why widespread misunderstandings about our unusual context presents an investment opportunity for those with confidence and patience.

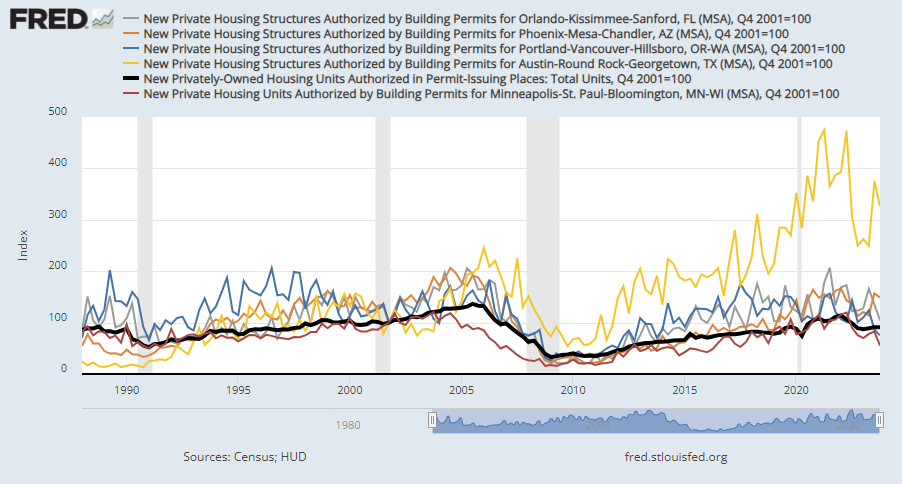

First, just a quick and dirty review of housing supply trends. I have pushed back on celebrations of Minneapolis. I hope their reforms bring down rents, but I don’t think the evidence is there yet. You can see in Figure 1 that Minneapolis (the metro area) hasn’t had a particularly strong trend in permits (red). In Figure 2, you can see that rents remained moderate in in Minneapolis in 2021, but the trend has turned back up.

This is a very simple analysis. It’s hard to separate supply from demand. But, I noticed that rents in Portland had sort of sidled into a good trend without me noticing. And, Phoenix and Orlando look decent recently. They all have had above average trends in new home permits lately. It is all marginal enough to be inconclusive, but as housing construction capacity grows coming out of Covid, we might be starting to see more of a clear correlation between more homes and lower rents over time.

Of course, as always, Austin is the true superstar here. Permits through the roof, and in spite of being the fastest growing large metro area in the country, rents over the past decade have remained moderate and the current trend is the winner. Austin isn’t just sprawling either. They are permitting a lot of apartments, and their downtown is being transformed.

The thing is, before this century, that’s what successful cities did. Austin is a superstar today, but it would have been merely a normal above-average city in the 19th or 20th century. When we were a “Real Country” (tm), we had a lot of Austins.

Austin is really the strongest case for a metro area that creates agglomeration economies through growth. And it makes this point, loud and clear: Agglomeration economies create value, not costs. High cost is not a signal of agglomeration economies. It’s a signal of quite the opposite.

More for subscribers about homebuilding trends below the paywall.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.