March 2024 Erdmann Housing Tracker Update

With notes on inflation

This month I’m going to start with a discussion of inflation. Housing is currently an especially important element because the CPI rent measure has a known, mechanical lag which makes it unhelpful during volatile periods. Unfortunately analysts and reporters, and frankly, a lot of economists, don’t seem to understand this, even though JPow! has discussed it frequently.

So, there are 3 problems happening now with reporting on inflation.

The endemic housing shortage creates an inflation signal that pushes measured inflation up by about 1%. This isn’t real inflation, and it certainly shouldn’t inform cyclical monetary policy decisions. There are many reasons for this. I have excluded shelter from CPI estimates for a decade. I hope to write more on this soon.

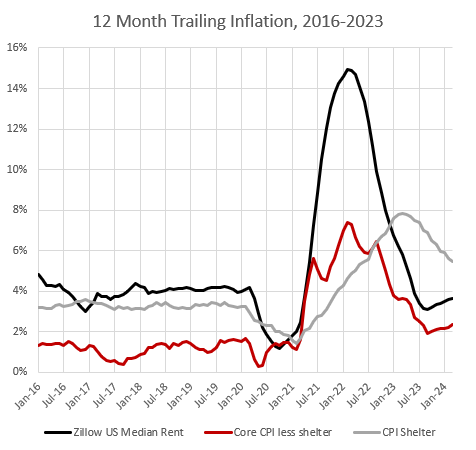

The CPI measure has a lag, which you can see in Figure 1. It is just mechanically slow to pick up price changes, because of the survey methodology.

In the current case, non-shelter inflation in 2022 was very high, and suddenly in July 2022, it fell permanently back to a 2% trend, where it has remained. In this case, which is unusual, year-over-year measures carry old information. The drop in inflation in July 2022 wasn’t fully reflected in annual inflation measures until July 2023. This problem, combined with point number 2, means that inflation has been at 2% since July 2022, but the shelter component is still picking up price changes that really took place 2 years ago.

Because of this, to my perpetual disappointment, public discourse about inflation is misguided and biased. In spite of what you’ve likely heard, the Fed doesn’t have any more work to do. We aren’t still waiting for the rate hikes to fully have an effect.

Fortunately, for the Fed, and for us, the continued recovery of several sectors from the multiple waves of Covid disruption have boosted real growth and real interest rates, making the Fed’s current posture less hawkish than it might have otherwise been.

In Figure 2, you can see that when you take Shelter out of the CPI, the trend (relative to the 2% Fed inflation target) has been and continues to be flat as a pancake. There is really no reason to spend much time worrying about inflation.

On the other hand, you can see in Figure 1 that timely rent inflation, as measured by Zillow, has started to rise again. The current run rate is about 5% for Zillow rent, which I would equate with about 4% CPI rent inflation. (See the 2016-2020 period in Figure 1.)

That means that our current level of construction activity is not sustainably high enough yet. It means we should expect either a building boom or the continued slow economic suffocation of America’s working poor.

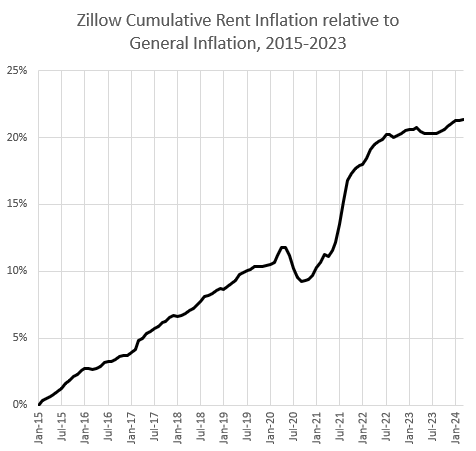

Figure 3 shows my estimate of the cumulative excess rent inflation since 2015. It briefly flattened out in 2022 and 2023, but it appears to be moving back into an upward trend.

More on the tracker update below the paywall.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.