December 2023 Erdmann Housing Tracker Update

We’re settling in nicely to the new boring.

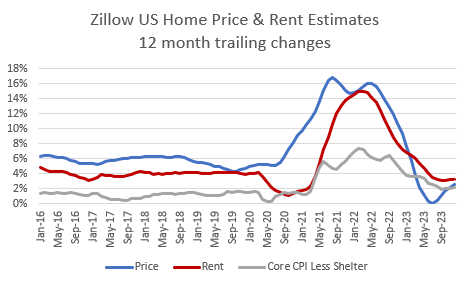

To recap: Before 2019, measured CPI inflation was near 2%, but that was a combination of non-shelter inflation below the 2% Fed target and rent inflation above 3%. (Rent estimated by Zillow, in red in Figure 1, was running at about 4% because of compositional shifts in the housing stock.)

Since excess rent inflation causes price/rent to rise, prices were rising at closer to 6% annually.

Then, the Fed started pushing the economy into marginally recessionary conditions. Since rent inflation is caused by supply-side problems, rent inflation continued, but there was a bit of a dip in home price trends.

Note, the Fed target interest rate had been increased until the end of 2018 and mortgage rates had risen moderately too. Then in 2019, mortgage rates started to decline and the Fed eventually started following them down with their target rate. Home prices didn’t moderate relative to rents in 2019 and 2020 because of high interest rates. They moderated because of marginally recessionary conditions.

Then Covid hit, and initially rents declined. But, eventually, urban outmigration, work from home, etc. led to rising rents. And, prices recovered from their previous cyclical slump and the pendulum swung positive.

Then, by 2022, the Covid spike receded, and rents started to moderate again. And, during this time, the price pendulum swung back down briefly so that by the summer of 2023, prices were back to a relatively neutral position.

Basically, all the price appreciation since 2015 has been a mechanical outcome of excess rent inflation, with cyclical fluctuations a few percentage points above and below neutral. Interest rates might be responsible for some portion of those small fluctuations.

And, today, CPI non-shelter inflation is right at the 2% target trend, Zillow rent estimates are a bit above 3%, suggesting rent inflation just above 2%. And, Zillow price estimates are moving back up. We’re in the first inning of boring. Take your tactical positions against whatever the interest rate obsessed crowd is doing and go take a nap.

The main remaining question here is, will housing construction finally start to accelerate, bringing rents down so that homebuilder growth is activity fueled, or will something continue to hold back construction growth so that homebuilder growth continues to be price or margin fueled.

This is the new boring, so the range of possibilities is relatively tight, I think. The supply constrained scenario probably will settle with price and rent trends below the pre-2019 growth rates. And ample supply is a long-term fix, so in that scenario, both rent and price trends will probably be at or above zero but below non-shelter inflation.

The most plausible risk is some sort of federal or mass movement against private equity investment, which would limit growth in single-family construction and move rent and price trends back up to the pre-2019 levels or higher. I’m afraid that would relatively quickly lead to dangerous socio-economic upheaval.

But, the baseline scenario is boring.

Now, on to the tracker data.

Keep reading with a 7-day free trial

Subscribe to Erdmann Housing Tracker to keep reading this post and get 7 days of free access to the full post archives.