Consulting

I am adding this tab to the menu to confirm, in case it wasn’t obvious, that I can provide financial consultation and analysis. Where my analysis can be most helpful is to track and forecast residential real estate valuation trends at the metropolitan area level, which are of a much more important scale than they have historically been, and are unusually predictable in ways that they have not been historically.

Single-family residential real estate markets currently are operating based on a set of predictable and systematic set of factors. Few understand them, because this is all new.

Here at Substack, I write about policy (mostly on the free posts) and about housing data that might inform personal investing decisions (mostly on the paid posts).

If you’re in the housing or construction sectors, or you are considering it, a detailed macro-level analysis of your markets, using my insights, can be valuable. This is a unique time for residential real estate markets. Largely unappreciated factors are moving individual markets in predictable ways, if you know how to look at them.

There are piles of proverbial $100 bills laying around all over the place today. I can show you where they are.

There’s the old story about the economist who lost his keys who keeps looking around under the street lamp, even though they clearly aren’t there.

“Why are you doing that?”

“Because that’s where the light is.”

Well, I’ve got a spotlight.

I’m an efficient markets guy. Most of the time, I assume the market price is the right price, based on currently available information.

My personal past as an investor has involved a series of large investments in equities that were deeply mispriced. For some reason, there are times when market efficiency breaks. I don’t fully understand why. Sometimes it’s psychology. Sometimes it’s just a change in fundamentals or a new economic context, and it takes the market some time to understand it or trust it.

Patrick Industries was one case. I had taken a position that was somewhat speculative. Operations needed to improve, but improvements were likely. In October 2011, they reported quarterly earnings which were music to my ears. Everything that needed to happen was happening. I logged on to see how high the stock was soaring. No shares were trading at all! I could still buy more even though the news was out. Today it’s a $3 billion company. Then it was only a $20 million company. Nobody was watching! Nobody knew where to look. They were all convening under the street lamp, and a corporation that they thought was a $20 million corporation was out in the shadows.

The last time that happened was the summer of 2019 when I went all in on K. Hovnanian after they received a delisting notice from the New York Stock Exchange. It was obvious to me that they weren’t going to be delisted and that they were at a turning point to better days with an insane amount of operating and financial leverage. I knew then that the scenario that has played out for them was likely. Clearly that was an inefficient market. This wasn’t luck. There was no scenario analysis with any realistic probability attached to what has played out that would have valued them at $6 in the summer of 2019. The market was broken. It was selling dollars for pennies.

Then Covid arrived. In my view, Covid actually interrupted Hovnanian’s recovery. But it added a another novel new factor driving housing markets and valuations in a market that was already broadly misunderstood.

Anyway, I share these personal anecdotes to note that, for what it’s worth, I have a history of successfully identifying mis-valuations. Past performance doesn’t guarantee future success, etc. etc. But, it seems like a relevant history to share. I’m not a policy guy who’s trying to do finance. I was doing finance and tripped into policy work because the financial issues I discovered added up to something substantial.

My policy work has mostly been through the Mercatus Center at George Mason University, but I perform my analysis independently because the factors influencing real estate markets that I have discovered and quantified are new and novel. That’s what makes them valuable.

My Spidey senses are tingling today. But there isn’t just one turning point. Every city has a different market and a different turning point, and I can show you where all of them are. Some have already happened. Some are yet to come. For various reasons, predictable, documentable trends in American real estate markets may not be reflected in current prices.

This is new. Real estate is supposed to be local. Location, location, location. That is the skill set of every operator in the market. There shouldn’t be macroeconomic turning points that can dominate the local factors like there are now in housing markets. But, there are. Now is the time to take advantage of them.

Obviously, $100 bills were lying all over the place in, say, 2012. It took some bravery, and access to capital, to invest in existing homes then, but it really didn’t take any insight to figure out that buying a home with a $200 mortgage payment that would rent for $700 was going to work out ok. It might have taken insight to know that today that home would be renting for $1,400, but you didn’t need to know that to know that the investment would pay well. That was a market in disarray. The market is orderly now, but the knowledge to see where valuations and production are headed has not seeped into its collective conscious.

I understand it. There are mispriced assets all over, and I can show you where and how much. Especially if you’re looking at investments in rental housing or land for residential development, I can show you where the $100 bills are.

Using a modified version of the Erdmann Housing Tracker that I update each month, I can highlight tipping points in markets across the country that local buyers and sellers can’t see. I can show you where to apply your local underwriting skills and operational management.

My analysis can include a number of details about every metropolitan area, such as estimates of the premium or discount on residential properties related to very large changes in mortgage access and housing construction in the last 20 years, estimates of the sustainable size of each market and the difference between current production and sustainable production levels, estimates of systematic and predictable rent trends, long-term risks of rent trends related to each metro area’s individual sensitivity to changes in mortgage access and new home production, etc.

Most importantly, I can provide you with a new way of thinking about these markets, which gives you a lucrative new margin on which to make decisions about allocated capital. It can transform the way you analyze a market.

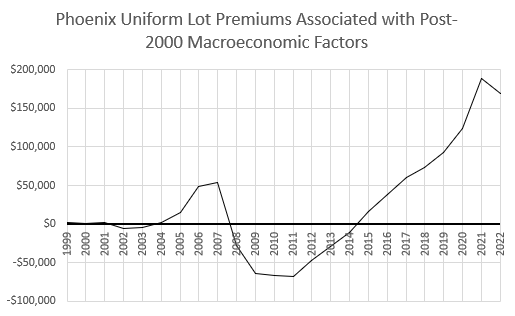

Here is just one example of the sort of output I can produce. This isn’t a comprehensive measure of lot valuations in Phoenix. There are many idiosyncratic factors involved in the total value of any given plot of land. This is the uniform value associated with all residential lots because of recent anomalies in American housing markets.

This line should be almost indistinguishable from the x-axis. It was before 2005. That bump from 2005-2007 was the housing bubble. The low point from 2009 to 2011 was the drop in home values related to the mortgage crackdown. The rise from 2011 to 2019 was the rise from rent inflation due to underbuilding. That was starting to moderate by 2019, but then Covid interrupted supply chains and prevented the Phoenix market from correcting.

Every city is following the same pattern since 2007, but at different rates of change. Each city’s path along these trends is predictable and verifiable. Understanding where these trends are in a given city can help to highlight where markets are not currently pricing in predictable patterns.

You can see the scale of the premium. Macro-related price premiums have never operated at a scale like this before. I can help you quantify them and act on them.

All the best on the consulting endeavor! Sure puts a new spin on “hanging out a shingle!”