August new residential home sales are out, and to my eye, they continue to defy the reports of a collapsing housing market.

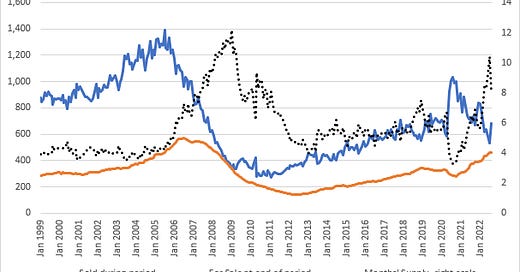

Here are some charts updated from last month. First, homes sold, for sale, and months of inventory. There was a blip up in sales, which caused “months’ of inventory” to retreat sharply from last month’s high. There is little reason to look to months’ of inventory for any insights about the housing market, so it doesn’t really matter. Here, as always, it mostly just reflects changes in sales.

Sales has been noisy, and continues to be (probably because it has become somewhat unmoored from construction, since accumulated sales are still well ahead of capacity to build). The noise was up this month. Homes for sale continued its trend.

The for sale inventory continues to be highly weighted toward units under construction or not started. Completed homes bumped up a notch this month, but remain very low.

Here’s the chart from last week’s residential construction report. Homes under construction as a % of homes completed each month remains elevated. Homes under construction continues to be a signal of supply constraints rather than speculative building.

Even though the number of finished homes for sale moved up a bit, the average number of months a finished home has been for sale plummeted to a new record low. From 2.4 months last month to 1.7 months this month.

Finally, one measure I like to check is average sale price of new homes sold x the number of units sold. This has been noisy because both prices and quantities have been volatile (again likely because of the supply constraints that have extended backlogs). The noise was up this month. Total sales remains well above pre-Covid levels. Again, no sign of collapse.

Sometimes, I worry that I’m being too strident in claiming that home prices aren’t about to collapse, etc. But, looking at this data with eyes as naïve as I can manage, trends in the market for new homes seem relatively strong. It almost seems hard to believe when I compare it to the shift in tone on headlines and comments from some reporters and industry pundits.

It will be interesting to see ongoing impact of 30 year rates on sales and starts over the next few months. I also wonder if the aftermath of Ian will do to supply chains in Florida and South Carolina. My best guess is a temporary spike in material prices, but no big disruptions. Granted, some of the stuff they'll be rebuilding shouldn't be rebuilt, but that's another story.

Could the story be that builders are in a hurry to sell what they have completed or mostly completed, but they are not very interested in starting a lot of houses or doing a lot more work on them? What is the probability that sales fall off a cliff in the fourth quarter?